|

|

|

PRODUCTION POWER: Workers man a line at Shuanghui International Holdings Ltd. in Luohe, central China's Henan Province. Shuanghui, China's largest meat producer, offered to buy U.S. pork giant Smithfield Foods Inc. for $7.1 billion, including debt (ZHAO PENG) |

Zhao warned of a "glass door" that exists in overseas investment, something that Chinese companies should be cognizant of. "You can see through the 'glass door,' but you can't go through it. You have to understand the hidden rules behind the written ones. That's why Chinese companies should do more research before going global," Zhao said. "You can never be too careful."

But many Chinese companies, especially state-owned enterprises, have had their ambitions for overseas acquisitions thwarted in recent years. State-owned CNOOC failed to buy American petrochemical corporation Unocal for $18.5 billion in 2005, a deal that foundered on U.S. allegations of national security concerns. On October 8, 2012, the U.S. House of Representatives Intelligence Committee issued a report alleging that Huawei and ZTE, two Chinese telecom companies, posed a possible threat to U.S. national security. The committee even urged the U.S. Government and the private sector to boycott the two companies. In 2012, U.S. President Barack Obama blocked a wind farm project by Sany Group, China's largest machinery maker, again on national security grounds. Li attributed those setbacks to mounting protectionism that surfaces when economies are in the doldrums.

Carolyn Ervin, Director for Financial and Enterprise Affairs with the Organization for Economic Cooperation and Development (OECD), however, said skepticism toward state-backed companies are not specially targeted at Chinese ones, but state enterprises in general. "A large part of the reason that countries are skeptical against state-owned companies is that they are concerned with their relationship with the government, such as unfair advantages in financing, hiring and resources," she said. To that end, China is working closely with OECD countries to make itself better understood, she said.

Marion-Bouchacourt agreed, saying that integration is the most important factor in overseas expansion. "It's all about building a partnership in a way that is acceptable and understandable."

Li said the Chinese Government should ease away from state-owned enterprises in order to address the concerns of foreign governments and should provide privately owned companies with more access to financing. Finally, if companies were the only decision makers regarding overseas expansion, they would be more rational, said Li.

Learning from failures is also extremely important for Chinese firms with a bent toward global expansion, but most failed cases are not disclosed to the public, said analysts during the 17th CIFIT.

Zhao said there are far more failed cases of overseas acquisitions than successful ones. "People love to flaunt successful cases but avoid talking about failures. This is a very serious problem," he said.

"Chinese companies should carefully study those failed cases and learn from them."

(Reporting from Xiamen, Fujian Province)

Email us at: zhouxiaoyan@bjreview.com

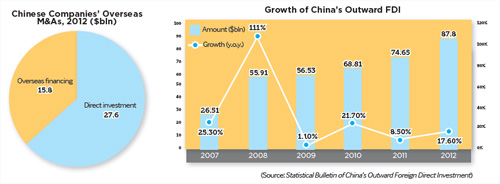

China's Outward FDI in 2012

As of the end of 2012, China's accumulated outward FDI stock volume stood at $531.94 billion, the 13th largest in the world. China's outward FDI grew 41.6 percent annually between 2002 and 2012. The government has set a goal of increasing outward FDI at an average annual rate of 17 percent through 2015, when it is forecast to reach $150 billion. Chinese investors have established about 22,000 overseas enterprises in 179 countries and regions.

China's non-financial outward direct investment grew by 13.3 percent to $77.73 billion, accounting for 88.5 percent of the total outward FDI. Outward direct investment in financial sectors surged 65.9 percent to $10.07 billion.

China's direct investment in developed economies reached $13.51 billion. The United States received $4.05 billion in Chinese investment, an increase of 123.5 percent year on year, thus becoming the second largest overseas destination for Chinese investment, after Hong Kong.

Chinese enterprises completed 457 outward merge and acquisition (M&A) transactions valued at $43.4 billion, both record highs. The M&As covered 10 sectors, including mining, electricity, culture, manufacturing and transportation. |