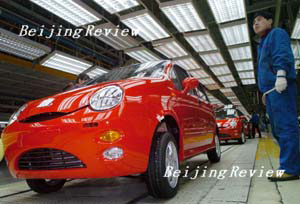

Automobile history got a giant rev at the Detroit Auto Show on January 8, when China's Geely motor manufacturer rolled its 7151 CK sedan into the spotlight. This marked the first time the over-50-year-old local auto industry had exhibited a homegrown product at the prestigious show.

President of Geely Li Shufu said this vehicle had been fully designed and built by Chinese engineers and Geely possessed the complete intellectual property rights.

Apart from securing Geely's fortunes, the move augurs well for all Chinese auto brands.

In October 2005 another Chinese auto upstart, Chery Automobile, developed an engine named ACTECO, which Chery installed in its new series of Dongfang Zhizi (son of the east). The birth of the first car with a "Chinese heart" indicated the company had mastered the core technologies in manufacturing a complete vehicle, especially the most technologically advanced parts of engine and gearbox.

For over 10 years, vehicle brands of multinational auto giants and joint ventures have dominated China's auto scene. Although some Chinese entrepreneurs have been devoted to developing China's national brands, their efforts have been undercut by the competition of foreign and joint brand names. Many analysts believe the main body of the auto industry has been sliding into the Brazilian model, featuring the domination of foreign investment and the transformation of the whole industry into a shipyard of foreign brands. In view of that, China's original plan of developing its auto industry through trading a market for technology has proved to be a failure.

As for the prospects, China's auto industry is wrapped in confusion and pessimism. At an international business summit in September 2005, some auto industry analysts stated that the progress of Chinese national brands would be slow, if any, for the next 30 years, and substantial changes would be unthinkable. However, some more optimistic analysts said it would take three years to judge whether the Chinese auto industry could make any progress.

Until 2001, only three of the leading car brands in the Chinese market had been those manufactured in China. Yet in the past five years, over 200 models under dozens of brands have entered the market.

Slow start gains momentum

In 2005, the sales of Chinese national brands occupied 25 percent of the market. In the first half of 2005, the sales of homemade cars accounted for 55 percent of the total sales of the top 10 "economy" cars in the Chinese market. Chinese brands have dominated the market for cars with an engine capacity of between 0.8 liters and 1.4 liters and below the price of 60,000 yuan. The development of these models is consistent with the Chinese Government's advocacy for building cars of low-emission and low-consumption of fuel. On the list of new cars to be launched in 2006 in China, 15 of the 33 new models are developed domestically.

In terms of monthly sales ranking for single models in 2005, Chinese brand Xiali is way out in front, followed by Chery and Geely. In the first 11 months of 2005, Geely's sales volume increased by 30 percent year on year, much higher than the average level of China's auto industry. Investment bank Bear, Stearns & Co. Inc. maintains that Geely is making the transition from low-end cars to those of high value for money.

At the turn of 2006, many domestic auto companies set their sights on the medium-to-high-end market. At the end of 2005, Chery announced that it intended to build China's own "Rolls Royce" cars and that their design is underway. Some experts believe that climbing up the value-added ladder could be the second revolution of auto in China.

Besides permeating through the domestic market, some Chinese brands have cast their nets globally. Statistics demonstrate that between January and August 2005, China exported a total of 100,000 complete vehicles, representing a year-on-year increase of 148 percent. Meanwhile, China's auto imports are on the decline. Between January and September 2005, China imported 94,000 complete vehicles, which marked the first time in Chinese history that exports overtook imports in number.

Driving onto foreign shores

The main export destinations of Chinese cars include Africa, Middle East, Central Asia, Southeast Asia and Latin America. Among these exports, Chinese homegrown brands have a brilliant performance. For example, in the first half of 2005, the homegrown Great Wall Motor exported nearly 4,000 complete vehicles, which equaled its total exports in 2004. Another Chinese brand, Changan, exported 700 SUVs to Europe, becoming the first Chinese auto company to do so.

Meanwhile, Chery cars are becoming market favorites in Syria. A local sales agent said besides competitive prices, customers are impressed by the quality of the cars.

As a matter of fact, before China's impressive large-scale auto exports in recent years, the auto industry had maintained a modest presence in the international market. For over 10 years, the conundrum of dependence on imported cars, against failure to export vehicles built in China, has hindered the development of the domestic auto industry.

Zhao Ying, a research fellow with the Institute of Industrial Economics of the Chinese Academy of Social Sciences, said that since 2005 the Chinese auto industry has taken meaningful steps into the world of auto development. But he also noted that auto exports are still low-end products, which represented a meager proportion of the international auto trade.

It's true that the Chinese auto industry is in its infancy and faces numerous difficulties and unexpected barriers. For example, not long after Land Wind, produced by the Jiangxi-based Jiangling Holding Co., entered the European market, it has been plagued by questions over its safety standards. The ambitious Chery has also met with setbacks in its expansion in Malaysia, where not only the sales of Chery's complete cars are banned, but also the sales of locally assembled Chery cars with imported parts.

Commenting on the internationalization of Chinese car brands, Dong Haiyang, Deputy General Manager of FAW Toyota Motor Sales Co., a joint venture between Toyota and China FAW Group Corp., has expressed his concern.

"As far as the FAW Group is concerned, in order to become the heavyweight brand of the mainstream market, the priority is the domestic market, rather than the international market," said Dong.

Dong said the glory of exporting cars of many homegrown auto companies is quite superficial. "I don't favor some companies' rush to export cars without mature conditions. The cost of exporting could be as large as the loss of business on the domestic market for dozens of years."

Xu Gang, President of the Shanghai Maple Automobile, thinks that the key to forming core competitiveness in the industry is to put more efforts into developing proprietary brands. Xu believes it is critical to be independent in five key areas: research and development, production, brand management, product upgrading and quality control.

"The ability of independent development is essential," said Gao Xu, a senior analyst with McKinsey & Company. "It is impossible to foster independent development ability by setting up joint ventures," he added.

Sort out home industry

The overall domestic environment is also a setback for the development of China's national car brands. For example, China's technical base of auto parts has been weak and lagged behind the production of complete cars due to insufficient investment. This has led to a situation in which parts involving core technologies of cars made in China have to be imported, usually at prices higher than they would cost internationally.

Insufficient funding for research and development is another problem requiring immediate solution. The research and development expenditure of Chinese auto companies usually accounts for less than 1 percent of their sales volume, while this proportion is between 3-5 percent for foreign auto companies. General Motors invests $5-6 billion in developing new models every year. In comparison, the development budget of the whole Chinese auto industry is merely 2 billion yuan. On top of that, the industry has been suffering from a severe shortage of research and development personnel. Take China FAW Group Corp., China's largest auto company in terms of output, for example. FAW's technical staff accounts for 2.6 percent of the total staff number, while the proportion for Toyota is 9.8 percent.

As researcher Zhao Ying said, although 2005 saw the emergence of China's auto industry onto the international stage, there is still a long, long way to go.

|