|

Numbers of the Week

18.08 million

China's subscribers to 3G mobile technology increased by 4.83 million in the first quarter to reach 18.08 million at the end of March, said the Ministry of Industry and Information Technology.

490.8 billion yuan

The output value of China's media industry grew 16.3 percent year on year to 490.8 billion yuan ($71.9 billion) in 2009, said a report by the Research Center of Media Economics and Management at Tsinghua University.

TO THE POINT: In its latest attempt to calm the property fever, the government steps up controls over affordable houses. China's service trade reported the first decline on a yearly basis since 2001. Chinese shippers report jaw-dropping losses for 2009 due to collapse of global shipping. China's private airlines struggle in a market dominated by state-owned carriers. The Chinese Academy of Social Sciences lists Hong Kong as the most competitive city in China in 2009, with Shanghai and Shenzhen being the second and third. Stock market fluctuations caused fund management companies to spill red ink in the first quarter.

By HU YUE

Cooling the Rush

China has pushed all the buttons to tame the red-hot property market where price surges are bringing worries of a bubble burst to a boiling point.

On April 26, the Ministry of Housing and Urban-Rural Development announced a series of regulations over affordable houses for low-income residents.

The ministry said those who sell or rent out affordable houses or leave them vacant will be forced to relinquish ownership of the properties and will be ineligible for purchasing another affordable house for five years. Those who fake their qualifications must also return the houses.

Chen Yunfeng, Secretary General of the National Real Estate Manager Alliance, said this move would help protect interests of low-income groups and be a stabilizer in the feverish market.

Along with tighter mortgage rules and a clampdown on financing for developers, the new regulation adds to the impression the government is determined to restore the property market's health.

Trade Slowdown

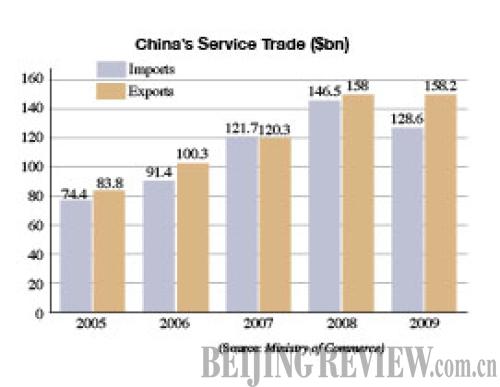

China's service trade volume went down 6 percent year on year to $286.8 billion in 2009, said the Ministry of Commerce (MOFCOM) in a statement on April 29. Of the total, exports dived 12.2 percent to $128.6 billion while imports were $158.2 billion, a minimum increase of 0.1 percent. The trade deficit came in at $29.6 billion, 1.6 times more than that of 2008.

More specifically, foreign trade in transportation and insurance services witnessed a sharp drop, but that of tourism, finance and information services defied the downturn to see a substantial run-up.

With the global business climate warming up, the country is geared for a10-percent growth in its service trade in 2010, said the ministry.

The world economy is retracing some of its lost strength, putting a solid floor under the transportation sector. Meanwhile, tourism services are also poised for success with the help of the Shanghai World Expo and Guangzhou Asian Games, said the MOFCOM.

But meeting the target will not be without difficulties. Much progress still needs to be made in China to increase the level of services and gain an international competitive edge, said the ministry.

Shipping Uncertainties

When the economy slowed last year, few industries were as hard-hit as the shipping sector, which found its vessels stuck at port as global sea-borne trade fell off a cliff.

Two shipping giants—China COSCO Holdings Co. Ltd. (COSCO) and China Shipping Container Lines Co. Ltd. (CSCL)—were among the victims, reporting losses of 6.3 billion yuan ($922.7 million) and 6.5 billion yuan ($952 million), respectively, in 2009.

Their container lines and dry bulk operations—transporting bulk commodities such as iron ore and coal—declined to a trickle, leaving many vessels idle. Even more troubling was the sector's overcapacity problem as the large order of vessels made before the financial crisis finally hit the oceans.

|