|

It is hard to judge the effect of the NDRC's attempt to regulate edible oil prices. Li Guoxiang, a researcher at Rural Development Institute of the Chinese Academy of Social Sciences, said regulating edible oil prices in advance can counteract influence of the international market and prevent further sharp price hike.

Li said grain price in the international market transmits to the domestic market in two ways. First, it changes the expectations of market traders, which can be detected from the sharp rise of farm produce futures price in domestic commodity exchanges. Second, through imported farm produce it influences the prices of agricultural and sideline products, including prices of both upstream and downstream products. Such transmission has not yet been seen at present.

According to a report by the Department of Strategic Planning of Agricultural Bank of China, grain price hikes in the international market may push up grain prices in China. However, since 95 percent of China's staple food consumption such as wheat and rice is satisfied with domestic supplies, and inventories of these grains are ample, general supplies will not drop dramatically and prices of wheat and rice are unlikely to soar.

According to figures from the National Bureau of Statistics (NBS), in July, grain prices rose by 0.2 percent over the previous month and by 3 percent over a year ago. The monthly growth was 0.1 percentage point higher than in June, but the yearly growth dropped by 0.2 percentage points.

In the first two weeks of August, in the edible agricultural products price index published by the Ministry of Commerce, food prices grew by 0.1 percent and 0.2 percent on the weekly basis respectively, which was on a normal level.

Li said China's grain supplies have a high degree of self-sufficiency, less affected by the international market. Moreover, domestic grain production has seen a bumper harvest for nine consecutive years, therefore domestic grain supplies keep stable and big price hike is unlikely in the future.

NBS figures showed that in 2012, China's total output of summer grain reached 129.95 million tons, up 3.56 million tons or 2.8 percent year on year, surpassing a record high in 1997. Supplies of summer grain are ample. Based on present information, a bumper harvest is expected for autumn grain production.

Li said judging from China's macroeconomy, the country won't face heavy pressure from price hikes. Grain prices account for a major proportion of the consumer price index (CPI). In July, the CPI rose by 1.8 percent, the lowest since February 2010, and lower than 2 percent for the first time in the past 30 months. The central bank didn't relax the monetary policy in August, therefore even though the CPI may rebound in August, the growth won't be high. This indicates that China's pressure of a grain price hike is not serious.

According to Li, China hasn't adopted market-oriented pricing measures for domestic farm produce, and the government often issues policies to regulate grain prices. China has already set up a grain reserve system and minimum purchasing price system. Once grain prices soar, the government can curb prices and stabilize domestic grain market through auctioning grain reserves.

"China's self-efficiency of rice, wheat and even corn is very high, but now the international and domestic grain markets are closely connected. As the world's most important grain exporter, the United States was hit by serious drought disaster, causing the grain prices to soar. It will be fruitless for China to attempt to isolate the domestic market from the international market so as to prevent any impact from the international market," said Li.

Although the domestic grain market is stable now, the government should prevent international grain price fluctuations from being transmitted to the domestic market, he said.

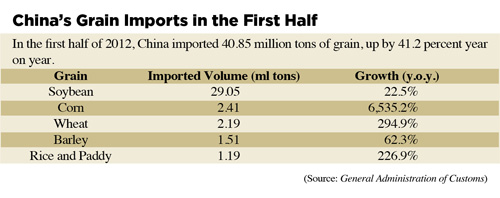

According to figures from the General Administration of Customs, during the January-July period, China imported 8.68 million tons of cereals and cereal flour, up by 261.3 percent year on year. Related government departments should be vigilant for such rapid growth.

As a big grain consumer and importer, China should not be too scared, said Li. With reserve grain in hand, there is no need for panic purchasing of grain. The high grain prices in the international market are expected to drop in some time. If China, the largest soybean buyer, does not purchase, the high international soybean prices would not last, he added.

Moreover, China should make appropriate readjustment to the import and export policies of farm produce. Particularly, when international grain prices remain high, China should be prudent in importing grains. With nine consecutive bumper harvests, China has amassed a big inventory. At this time, it should increase grain exports.

Email us at: lanxinzhen@bjreview.com |