|

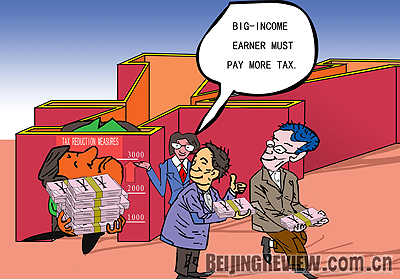

The Chinese Government's recent economic stimulus measures are attracting much attention because of its plan to increase people's incomes and alleviate enterprises and residents' economic burden. Quite possibly, the burden alleviation package will also cover tax reduction measures like raising the cutoff point of the individual income tax.

It was reported that the Ministry of Finance and the State Administration of Taxation had already submitted a new taxation scheme to the State Council, China's cabinet, which proposed to raise the individual income tax cutoff point to 3,000 yuan ($430) from the current 2,000 yuan ($300).

If the proposal is approved, it will be the third adjustment of individual income tax cutoff point within three years. China started to collect individual income tax in 1981. In January 2006, the cutoff point was raised from 800 yuan ($115) to 1,600 yuan ($230). Since March of this year, it has been reset at 2,000 yuan.

Some scholars even suggested raising the cutoff point to 8,000 yuan ($1,150) or more, explaining that during the early days of individual income tax collection, the cutoff point was 800 yuan and the national per-capita income was about 100 yuan ($15) every month. But the per-capita income level has soared and in some coastal regions the figure is 2,000 yuan. "Based on the initial income and tax ratio, today's cutoff point should be raised to 10,000 yuan ($1,430)," they said.

As for the individual income tax policy, some believe that the government should distribute the tax collected from the high-income class to the low-income people, instead of collecting taxes from all people regardless of their actual income and living conditions.

Meanwhile, others say that too much attention to the cutoff point is unwise. Generally, the family is the basic consumption unit in Chinese society, so it's better to levy income tax on households, instead of individuals. Since Chinese are burdened with spiraling housing costs, tax refunds for house purchasing are in urgent need.

Raise cutoff point

Ren Mengshan (China Times): When the cutoff point was at 2,000 yuan, there was heated debate, as many people believed the threshold was too low given the heavy economic burden on Chinese consumers. This results from exorbitantly high housing prices, insufficient social security benefits and huge expenditures on health and education. Sharply raising the cutoff point this time is a natural thing to do.

Meanwhile, if the government hopes to boost domestic demand, it should ensure people have enough money to spend. Against today's global economic slowdown, many enterprises are busy cutting jobs, so it's impossible to expect businesses to increase salaries for their employees. If the cutoff point of individual income tax is raised at this moment, it will increase people's disposable income.

More importantly, the state is financially capable of doing this. The individual income tax only accounts for 7 percent of the state's tax revenues. If the raised cutoff point could strengthen the public's consumer confidence as expected, the lost individual tax revenues would be made up in other tax items.

Wang Yi (Xi'an Evening Post): Even if the cutoff point of the individual income tax were raised to 3,000 yuan, still, low- and middle-income earners would contribute the majority of the country's individual income tax revenues. To some extent, the current individual income tax system is only favorable to a small group of rich people.

The major consuming group in China is the working class, which means the government needs to fill their purses. Tax reduction is undoubtedly an effective way to realize this goal.

Actually, if the cutoff point is fixed high, supplemented by the progressive tax system, the low-income majority can benefit most.

The global financial turbulence is undoubtedly presenting a good opportunity for the country to overhaul its current individual income tax policy. Since the government has repeatedly stressed the importance of expanding consumer spending, the slow pace in raising the cutoff point of the individual income tax won't help much against the backdrop of the economic slowdown.

Lu Zhiming (The Beijing News): We have no tax refund system for individuals, so to raise the cutoff point of the individual income tax is somewhat equal to a tax refund for low- and middle-income earners. Experiences in other economies show that tax refunds and other subsidy policies can only temporarily boost domestic demand, while raising the cutoff point of the individual income tax will work in the long run.

Therefore, to raise the cutoff point is an irreversible trend of the macroeconomic policy. As some economists have pointed out, to raise the cutoff point sharply this time will not only increase people's income, but also save future headaches of frequent cutoff point adjustments.

Zhou Dongfei (Xiaoxiang Morning Herald): Given the possible drops in tax revenues in 2009, some officials and economists have spoken against raising the cutoff point of the individual income tax. Actually in 2007, the individual income tax only made up 7 percent of the country's total tax revenues.

|