|

There's more good news on the China investment front. According to the 2006 Annual Study Report on Private Equity Investment in China issued by Zero2IPO in Shanghai in December 2006, China has become one of Asia's most active private equity investment markets.

The data from this report was obtained from a Zero2IPO research center investigation of private equity funds with active investments on the Chinese mainland. The results of the investigation showed that from January to November 2006, 35 private equity funds that invest solely in the Asian market (including the Chinese mainland) successfully raised capital of $12.161 billion. Private equity funds on the Chinese mainland invested in a total of 111 cases during the same period, with 68 private equity funds involved in total investments of $11.773 billion. These figures made China the second most attractive private equity fund investment market in Asia, right behind Japan. According to an estimate by the Zero2IPO research center, the total amount of private equity investments in China in 2006 would account for more than 1 percent of the country's GDP.

The second half of 2006 saw even faster growth in the amount of capital raised by private equity funds. According to Zero2IPO statistics, from July through November, they raised $7.53 billion, a 62.6 percent increase compared to the first half of 2006.

Spotlight on traditional industries

With regard to industry preferences, traditional industries are most favored by private equity funds. In 2006, 63 private equity investments were made in traditional industries in China, accounting for 56.8 percent of the total annual investment, according to the Zero2IPO report. The total investment in traditional industries was $5.623 billion, or 47.8 percent of the total annual investment. For both investment case and amount, traditional industries came in first among private equity investments. The service industry came second, attracting $4.521 billion, or 38.4 percent of the total annual investment. Thanks to the global IPO of Industrial and Commercial Bank of China, the total private equity investment in the service industry in 2006 increased sharply. With regard to industry preferences, traditional industries are most favored by private equity funds. In 2006, 63 private equity investments were made in traditional industries in China, accounting for 56.8 percent of the total annual investment, according to the Zero2IPO report. The total investment in traditional industries was $5.623 billion, or 47.8 percent of the total annual investment. For both investment case and amount, traditional industries came in first among private equity investments. The service industry came second, attracting $4.521 billion, or 38.4 percent of the total annual investment. Thanks to the global IPO of Industrial and Commercial Bank of China, the total private equity investment in the service industry in 2006 increased sharply.

Exit strategy: IPO

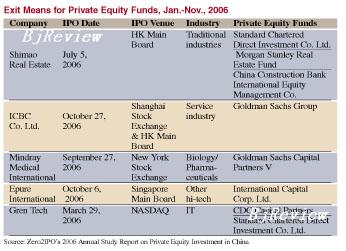

According to the investigation's results, 26 private equity funds successfully exited investments in 2006. IPO was the most common means of exit for private equity funds, supporting 17 enterprises that successfully exited by way of IPO. Four private equity funds successfully exited by selling stocks in the secondary market.

According to PricewaterhouseCoopers statistics, HK$300 billion was raised through IPOs in the Hong Kong market in 2006, creating a new record. According to PricewaterhouseCoopers statistics, HK$300 billion was raised through IPOs in the Hong Kong market in 2006, creating a new record.

In December 2006, at the Chinese Private Equity Market International Seminar, Wu Xiaoling, Vice Governor of the People's Bank of China, stressed that private equity funds should be encouraged to become major institutional investors in the Chinese capital market. Private equity funds are developing smoothly in China, and with progress in the establishment of a multi-tier capital market system and the implementation of relevant laws and policies, more capital will be attracted to the Chinese private equity investment market.

|