|

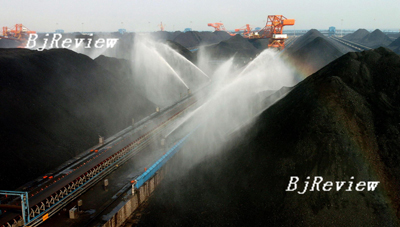

China is attempting to dig its way out of the trap of inflation. Standing in its way is the rising price of power-generating coal.

In mid-December 2007, coal producers and power plants came to an agreement that the price of power-generating coal would rise 10 percent in 2008, adding 42 billion yuan ($5.7 billion) in additional costs for the power plants. What actually lies behind this new agreement is the power plants' reluctance to bear the escalating cost, since their profit margins will take a further hit after already absorbing a difficult 9-percent rise in 2007.

To preclude their fears from materializing, the five large power groups of China had turned to the National Development and Reform Commission (NDRC) before the agreement, asking for a hike in the price of electricity in order to take the pressure off their companies. This was the third request of theirs for price rise submitted to the NDRC in 2007.

Current electricity prices represent a delicate problem for China. Once electricity prices rise, the cost of other products could rise as well. Caught in a difficult decision due to inflationary pressures, the NDRC shelved making a decision on the price hikes.

However, as relevant policies stipulate, the electricity price is allowed to rise in reaction to anything over a 5-percent rise in the power-generating coal price within a period of six months. This is termed the "coal and electricity price linkage mechanism" by insiders. Its implementation has occurred in China twice, in 2005 and 2006, respectively.

As a result, the price hike of electricity in tandem with coal has become an irrefutable fact, in defiance of the NDRC's silence.

Yang Linjun, Secretary-General with the Fuel Branch of the China Electricity Council, spells no doubts over the future trend. "The electricity price is bound to rise," Yang said. "But the growth range and time depend on the ability of society to bear the cost and the macroeconomic controls of the government."

A cautious line

Tightening its grip on the macroeconomic situation, the Central Government is striving to relieve pressures on the market in hopes of fostering steady and balanced development. To put a damper on the overheating economy, the 10-year-old "prudent monetary policy" was replaced by a tightened one at the recently concluded Central Economic Work Conference. Because of this, the NDRC is taking a cautious line on possible inflationary pressures arising from higher electricity prices.

According to Han Meng, a researcher with the Research Office of Macroeconomics under the Chinese Academy of Social Sciences, electricity, as a pivotal energy source, can exert direct influence on the production costs of many industries. Soaring electricity prices could be the trigger, possibly further igniting prices of consumer products to collectively swirl out of control. In the aftermath could be inflation of salaries, interest rates and rents, and an overall higher cost of living. Undoubtedly, standing at the end of this disaster chain could be severe inflation.

The five power groups asked to bump the electricity price up by another 0.2 yuan from the current basis of 0.5 yuan per residential electricity unit and 0.9 yuan per industrial electricity unit. The Consumer Price Index (CPI) would skyrocket at least 1 percent following a 0.2-yuan spike of the electricity price (1$=7.3 yuan).

In 2007 the CPI continued to soar, striking an 11-year high by surging 6.9 percent in November year on year, far in excess of the prescribed growth range of 3 percent. In a vigorous effort to steady the economy, the central bank raised the reserve requirement ratio 10 times and lifted the interest rate six times in 2007, mirroring the tightened monetary policy. "To elevate the electricity price at present will offset the effect of these measures, obviously something detrimental to China's economy," Han noted.

Self-help

Thermal power currently constitutes 80 percent of China's total installed capacity, and coal contributes 60-70 percent to the total cost of power generation.

In 2007, the thermal power plants of over half of the major domestic power groups and energy investment corporations ran at a low profit or a deficit. This also served as a reason for the five power groups to ask for a price rise.

Others say the pressure on the power plants was overrated. As the NDRC revealed, the power plants are netting swelling profits. In the first five months of 2007, the electricity industry raked in 63.7 billion yuan ($8.6 billion), up 57.6 percent over the previous year. The thermal power plants saw their profits rise 55.4 percent.

Slashing energy consumption is also instrumental in lowering the costs beside the price realignments, Han pointed out. Currently, domestic power plants report an energy consumption rate of 40 percent, which dwarfs their overseas counterparts, whose rate stands at 10 percent. In this case, China still has room to make strides in energy conservation.

A variety of energy-saving measures have been enacted to improve energy efficiency, but these are still not forcible enough. Most thermal power plants are engaged in low technology, low added-value production. Large-volume and high-parameter thermal power generators only have a measly 20-percent presence in the power plants.

Recommended solutions

Liang Dunshi, Deputy Secretary-General of the China Coal Transportation and Marketing Association, pointed to the supply-demand relationship as the major factor determining the power-generating coal price. China posted an 8-percent jump in coal output in 2007, still far behind the 17-percent growth rate of power plants. Moreover, the strained transport capacity of major coal-producing areas further constrained the newly added coal production capacity. So coal used for power is bound to become more expensive.

Behind the scenes, the inadequate pricing mechanism was found to be the culprit.

Since 2006, the price of power-generating coal has floated in line with market demand, free from the control of the NDRC. Lingering well short of the market price in the past, the price immediately leapt up to par with the market. Since electricity prices are still set by the government and rising coal prices cannot be linked with the overall electricity price quickly, the rising costs are shouldered by the power plants themselves. Faced with continuously growing power-generating coal prices, the failure to correct the electricity price will further aggravate the industry's existing problems.

Han noted that relevant departments should pay attention to straightening out the pricing mechanism of coal and elelctricity and stepping up the market-oriented reform of electricity price. But, he added, these are insubstantial.

In China, coal and electricity industries are interdependent, but mired in ceaseless price brawls. When the power-generating coal supply falls short of demand, huge pressures pile up on the electricity industry. But when the demand for electricity goes anemic, coal producers suffer from plunges in prices and an oversupply of power. China's economic boom in recent years has buoyed electricity demand, shoring up the price of coal-produced electricity.

Under such circumstances, the power plants have been struggling under the strain of power generation, power transport and power sales.

The best solution is to break the barriers between coal and electricity industries and hasten their integration, according to Han. "Coal producers should be encouraged to acquire power plants, and vice versa," he said. "All problems will be gone if the two become one." |