|

The cheap supplies flooded markets around the world, but it was the country's tolerance for quick and dirty extraction that made it the global leader. Producing each ton of rare earth could destroy 200 square meters of plants and cause massive water loss and soil erosion, said Lu Zhiqiang, Deputy Director of the Development Research Center under the State Council.

Ganzhou, a major production base of ion-absorbed-type rare earths in Jiangxi Province, provides a snapshot of the pollution nightmare facing China.

At its peak, the city had more than 1,035 licensed rare earth mines, said Li Guoqing, Director of Ganzhou Mineral Management Bureau, to Xinhua News Agency.

A common technique then involved the use of corrosive acids, which polluted vast farmlands and local rivers, he said. "The processing process took a painful toll on the ecological system; a green hill could turn into a moonscape within a few months."

To make things worse, half of the resources were wasted during extraction due to outdated technologies, he said.

Need to conserve

While China exhausts its limited resources, many Western countries are leaving their mines intact out of concerns over environmental pollution and labor costs.

The United States and Russia, for example, control 13 percent and 19 percent of the world's rare earth reserves, respectively. But neither of them has tapped the resources, relying on cheap imports from China instead.

The only U.S. rare earth miner, the Molycorp Minerals LLC. at Mountain Pass in California, closed in 2002 in response to environmental restrictions and high production costs.

Japan, meanwhile, has imported huge amounts of such minerals from China and kept part of the imports as "rainy day" reserves.

China needs to focus on conserving these strategic resources and curbing environmental degradation as it embarks on a green path of development, said Huang Xiaowei, Deputy Director of the National Engineering Research Center for Rare Earth Materials.

Besides, the country is also under domestic pressure for rare earths as its own hi-tech industries boom, said Huang.

"If no measure is adopted, China's rare earth reserves will dry out in 15 to 20 years," he warned. "We would have to dig deeper into our bag for expensive imports from countries like America and Australia."

Huang added that policy makers are expected to raise the environmental requirements for rare earth manufacturers this year.

"The government will likely allow another two or three years for them to improve their techniques," he said. "Those who cannot meet the standards will be forced out of the industry."

The impact

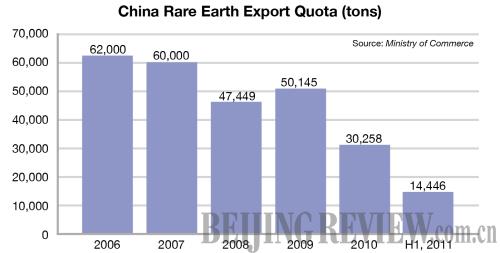

As China puts the brakes on rare earth exports, the far-reaching implications have already been felt. With supplies strained, export prices climbed 20-50 percent last year, according to data from MetalChina.com, a leading metal information website.

"Efforts are still needed to seek greater pricing power," said Li Junfeng, Deputy Director of the Energy Research Institute under the National Development and Reform Commission.

In a bid to reorganize the crowded industry, the government aims to cut the number of rare earth enterprises from the current 90 to 20 by 2015, he said.

With Chinese exports strained, some Western countries are worried about the future of their relevant industries. "The picture is not as bad as it seems since foreign companies can still purchase Chinese goods and components processed from rare earths, which are not subject to quotas," said Lin Donglu, Secretary General of the Chinese Society of Rare Earths.

Most importantly, China's restrictions and soaring rare earth prices are spurring mine development outside the country, he said.

The U.S. company Molycorp announced in March 2010 that it planned to resume operation in the second half of 2011 and expected to produce 20,000 tons of rare earths annually.

Meanwhile, Sumitomo Corp., Japan's third largest trading house, has joined hands with a local partner in Kazakhstan to explore a rare earth mine in the Central Asian country.

"China's export quota provides additional opportunity for us to meet the supply deficit outside of China," said Nicholas Curtis, Executive Chairman of Australia's Lynas Corp., which controls the world's richest known deposit of rare earths outside China.

The buoyant demands in the Chinese market, coupled with a sharp decrease in reserves, are a likely cause for the tightening of export regulations, he said.

"But it will take years for fresh supplies to come from deposits in Australia, North America and South Africa. The rare earth family is hard to find and harder to extract," said Lin.

Domestically, export regulations will offer a powerful incentive for manufacturers to move down the value chain and make a push into the unrestricted processing business of rare earths, said Ye Xin, a senior analyst at the Xiangcai Securities Co. Ltd.

Besides this, it is likely that more foreign hi-tech companies will move to China for an easier access to the precious resources, he said.

U.S. auto giant General Motors in July 2009 established its headquarters of international operation in Shanghai—a coincidence with China's curbs on rare earth exports, but a wise move for the company, which needs the minerals to build its Chevrolet Volt engine and battery.

Xu Xu, Chairman of the China Chamber of Commerce of Metals, Minerals & Chemicals Importers & Exporters, said the country still has a lot to do to power up its rare earth industry.

"Efforts must be made to further improve the technological expertise of extraction and processing," he said. "Meanwhile, it is necessary to strike hard against smugglers and enhance regulatory supervision over the sector."

The 17 Elements of Rare Earths

Scandium, Yttrium, Lanthanum, Cerium, Praseodymium, Neodymium, Promethium, Samarium, Europium, Gadolinium, Terbium, Dysprosium, Holmium, Erbium, Thulium, Ytterbium, Lutetium

|