|

|

|

(CFP) |

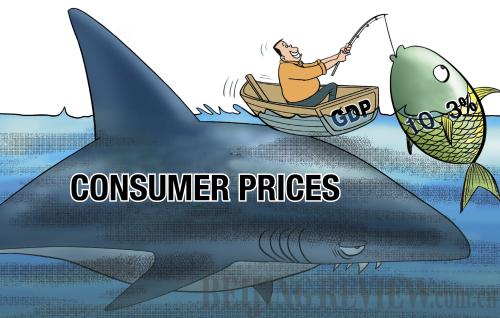

While the Chinese economy finds its feet after the financial crisis, anxieties are high as the seeds of inflation may be burgeoning. Just as it did three years ago, consumer inflation on everything from garlic to diapers and non-perishables is plaguing the world's second largest economy.

The consumer price index (CPI), a barometer of inflation, rose 4.9 percent in January from a year ago, said the National Bureau of Statistics. The biggest driver of the CPI was food prices including grain, meat, eggs and vegetables, which skyrocketed 10.3 percent in January over the same month of last year.

Newspapers are filled with reports of mainland tourists snapping up daily necessities like eggs and milk powder in Hong Kong where food prices are noticeably lower.

Inflation was not a serious concern in China until late last year as most economists had expected the CPI to peak in the middle of 2010. Instead, the index hit a 28-month high of 5.1 percent in November 2010, followed by 4.6 percent in December.

Rising prices

Gao Shanwen, chief economist at the Essence Securities Co. Ltd., said inflation is spreading beyond food, with production costs soaring in some sectors.

The producer price index (PPI), an effective gauge of inflation on the wholesale level, went up 6.6 percent in January year on year, accelerating from 5.9 percent in December 2010. The price of crude oil expanded 5.4 percent and that of raw coal increased 1.4 percent month on month.

"Our production costs have expanded 10 to 15 percent so far this year, which is eating into our profit margin," said Liu Liang, President of Donlim Kitchen Group Co. Ltd., an appliance maker based in Zhongshan, Guangdong Province. "We're trying to heighten operational efficiency and consolidate our customer base."

"With liquidity sloshing around the world economy, surging international commodity prices will push up the PPI," said Tan Yaling, Director of the China Forex Investment Research Institute.

According to the General Administration of Customs, China imported 68.97 million tons of iron ore at an average import price of $151.4 per ton, up 66.1 percent year on year. It imported 5.14 million tons of soybeans at an average import price of $558.1 per ton, up 20.4 percent.

In a recent report, the Chinese Academy of Social Sciences also expected international commodity prices to continue rising in 2011, driven by loose monetary policies in developed countries and solid demand in emerging economies.

Wang Tao, chief China economist at the UBS Investment Bank, said the PPI is expected to feed into consumer prices, complicating the inflation headache.

Chen Xingdong, chief China economist at the BNP Paribas Securities (Asia) Ltd., said the PPI will hover at a high level for the remainder of this year. But it is less likely to surpass 8 percent if the economy does not overheat.

The cause

The lending frenzy in the past two years provided a solid floor under what would otherwise have been a deeper downturn—it also flooded the economy with excess liquidity and planted the seeds of inflation.

New loans denominated in the yuan added up to 7.95 trillion yuan ($1.2 trillion) in 2010, overshooting the government-set target of 7.5 trillion yuan ($1.1 trillion). The number for January 2011 was 1.04 trillion yuan ($158.1 billion).

Yu Song, an analyst at Goldman Sachs, said China's inflation has become more widespread and more driven by fundamental forces, especially overly rapid aggregate demand growth, instead of random events such as bad weather, which pushed up food prices.

Li Yining, a renowned economist at Peking University, believes China is experiencing "cost-push" inflation due to four major factors: shortages of raw materials, short supply of agricultural products, labor costs inflation and land price increases.

"Cost-push" inflation would defy a quick fix, but supply-side measures should be more effective than monetary tightening, he said.

In addition, fears are proliferating that unbridled printing of dollars in the United States will compound China's inflationary headache.

The greenbacks produced by the United States have flooded the global market, pushing up international commodity prices and fueling inflationary jitters in China, said Guo Tianyong, Director of the Research Center of China's Banking Industry at the Central University of Finance and Economics.

Countermeasures

The policymakers have been pushing all the buttons to tame inflation. The government has pledged to take a prudent monetary stance this year, bidding farewell the moderately loose policy adopted to counter the financial crisis.

Inflation in China is broader and more stubborn than many economists have expected, forcing the central bank to rely on a mix of tightening measures, said Gao.

The People's Bank of China, the central bank, has ordered to raise the interest rates three times and the ratio of deposits commercial banks must set aside in reserves eight times since last year, punching the banks' ability to lend.

In addition, the State Council announced 16 measures in November 2010 to rein in rising commodity prices, including bolstering supply of agricultural products, enhancing price supervision and striking hard against speculation.

As part of its drought relief efforts, the government recently distributed heavy subsidies to disaster-stricken farmers and pumped investments to improve irrigation in wheat-growing areas.

Further policy moves are already in the pipeline since the government has put the task of fighting inflation at the top of its agenda.

|