|

Absolutely indispensable to the future of ChiNext is its relationship with the venture capital and private equity industry, just as in the case with Nasdaq in the United States.

In the first half of this year, 83 companies were listed on ChiNext and 61 companies were listed on the SME board, accounting for nearly 50 percent and 36.5 percent of the country's total, respectively, according to data of Zero2IPO Group, a Beijing-based research company.

For industry insiders, China's venture capital and private equity sector has a bright future with the development of a multi-level capital market covering the main board, SME board, growth enterprise board, the international board and the new tertiary board (a new agency share transfer system), said Liu.

The multi-level capital market could allow different types of investors to exit and realize their investment returns, said Tong Shaoqiang, a researcher with Guangdong College of Finance and Economics.

As a sector that China's 12th Five-year Plan (2011-15) vows to promote, venture capital and private equity investment will surely gain momentum in the next five years, said Jin Haitao, Vice President of Beijing Private Equity Association and Chairman of the Board of Shenzhen Capital Group Co. Ltd.

The country's 12th Five-Year Plan stated that China will vigorously promote the development of the financial market and encourage innovation in the financial sector. It will also boost the healthy development of venture capital and equity investment.

"In my view, the current five-year plan embarked on a golden five years for China's private equity market owing to strategic significance the country has endowed," said Jin.

Last September, the State Council selected seven strategic industries that it hopes to advance to spur the nation's economic development. It urged venture capital firms and private equity funds to finance their growth, according to the statement released by the State Council.

The country has put its hopes on venture capital and private equity to promote the strategic industries, which also provide us with opportunities, said Jin.

The blue sea turns red

If the venture capital and private equity industry can be dubbed a blue ocean—a term created by U.S. professors W. Chan Kim and Renee Mauborgne for uncontested market space—for its high profits and investment returns, today it is turning red as more capital pours in, stealing opportunities from current investors.

The stunning high investment returns have lured local and international venture capitalists to flock to China, said Zhao Linghuan, President of Beijing-based Hony Capital.

The profitable venture capital and private equity industry has become the new recipient of hot money, said Chen Yu, President of Beijing-based Shennong Capital Management. After the cooling property market and sluggish real economy drove speculative capital out, hot money has found refuge in this sector.

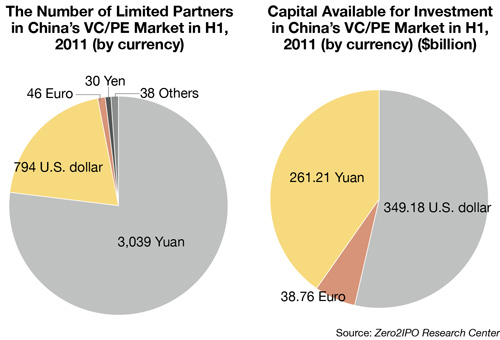

During the first half of 2011, a record $8.1 billion entered China's private equity and venture capital market, according to the Zero2IPO Group.

The dramatic influx into the venture capital and private equity sector pushed up investment costs. "Too much money is going after fewer good projects, which has made projects' offering prices soar," said Chen. "It also explains why the IPO prices were so high and many stock prices plummeted below its listing price after IPO," he said.

Although China's venture capital and private equity industry has made significant contributions to the country's economic development, propelling industrial upgrading, it still lags behind the demands for optimizing social capital structure and promoting private investment, said Zhu Zhixin, Vice Chairman of the National Development and Reform Commission.

Some venture capital and private equity firms are not regulated, said Zhu.

Since many private equity firms lack professional backgrounds, they often omit the process of getting sufficient information about a potential customer to determine their investment suitability, said Chen.

Despite the fact the country has not issued any state-level laws to regulate the whole industry, the industry should enhance self-discipline, said Jin.

It is vital to protect the interests of individual investors, he added.

"Many Chinese venture capitalists are not patient and want investment returns as soon as possible," said Chen.

Jin suggested Chinese private investors focus on enterprises in their early stages since they usually offer higher investment returns as a result of low investment costs.

Venture capital should accompany those enterprises to grow and develop while providing support and help in management and marketing. This is venture capital's value-added service and brings about higher profits, said Jin.

By taking this route, venture capital should keep their eyes open when making a decision. These investors should stick to their own principle in choosing projects and industries, he said.

A key point in deciding what projects to choose is whether it is included in the strategic emerging industries that the country promotes, he added.

|