|

"That's a nice break in a grossly bearish environment," Tao Dong, a Hong Kong-based economist at Credit Suisse. "I don't think that the Chinese economy is out of the woods, but any good news is great news."

Lian Ping, chief economist with Communications Bank of China, said the slowdown was inevitable as the country seeks to rebalance the economy toward more sustainable growth.

"Concerns over a sharper slump are overblown, and the slowdown remains within a reasonable range," he said.

In a recent report, the HSBC pointed to four reasons for limited downside risks.

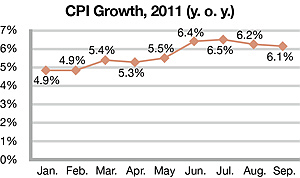

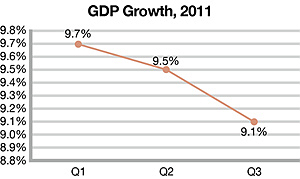

First, the tightening cycle is coming to a close since the CPI peaked in July. Stable monetary policy is expected for the coming month. Plus, the current credit growth of

15-16 percent is still sufficient to support around 9-percent GDP growth.

Second, external demand is set to cool, but not collapse.

Third, investment growth is bound to slow as the tightening effect continues to filter through. But the negative impact is offset by the acceleration of public housing construction and robust consumption, which supports consumer-related investment.

Fourth, domestic consumption has been vibrant thanks to a tightened labor market and rapid economic growth. The recent personal income tax adjustment will also boost household income.

Huang Yiping, chief economist for Emerging Asia at Barclays Capital, said China's solid balance sheet, backed by $3.2 trillion in foreign exchange reserves, current account surplus and a strong currency, will give the government enough room to adjust policies and prevent a deeper downturn.

Wang Tao, chief China economist with the UBS, agreed. "The economy glitters with a promising long-term prospect thanks to prolonged urbanization and improving industrial productivity," she said.

"Investment will remain a powerful driver as enterprises increasingly upgrade their businesses and move up the value chain," added Wang.

As fears over inflation take hold, economists believe policymakers are less likely to loosen their monetary stance, but they will tread more cautiously so they don't drain any more life out of the economy.

Li Yang, CASS Vice President, said it is still too early to ease monetary policies given the magnitude of inflation.

But the government is likely to replenish liquidity on a selective basis, perhaps by instructing banks to extend more loans to some priority sectors like agriculture and smaller businesses, Li Yang said.

Li Daokui, a member of the Monetary Policy Committee of the People's Bank of China and Director of the Center for China in the World Economy at Tsinghua University, said the country would take a wait-and-see mode regarding monetary stance.

China has largely controlled excess liquidity, but the problem of negative interest rates in real terms is yet to be solved, he added.

China's inflation ailment has showed signs of moderating, but the country still faces an uphill battle to contain consumer price surges.

The consumer price index (CPI), a barometer of inflation, grew 6.1 percent in September year on year and was 0.1 percentage point down from August. This was the second straight month of decline.

The biggest driver of the CPI was still food prices, up 13.4 percent in September over the same month last year. Pork prices, in particular, skyrocketed 43.5 percent. Residential costs climbed 5.1 percent, down 0.4 percentage points from July.

The producer price index (PPI), an effective gauge of inflation at the wholesale level, rose 6.5 percent in September, compared with 7.3 percent in the previous month.

It seems that the economy is still reeling from side effects of the massive monetary expansion two years ago. Moreover, the United States has the possibility open for yet another round of quantitative easing, threatening to complicate China's inflation headache.

Chinese policymakers have been pushing all the buttons to tame inflation. The People's Bank of China, the central bank, has ordered interest rate hikes three times, and the reserve requirement ratio has increased six times this year.

The CPI will continue heading lower for the rest of the year due to continued tightening policies, the bumper harvest of summer grain, as well as overcapacity in some industrial sectors, said Yao Jingyuan, chief economist with the NBS.

A more permanent solution is to underpin the foundation of agriculture and strengthen supervision over markets of agricultural products, he added.

"Food inflation in China is becoming more structural than cyclical, especially given the rising costs of farming materials and labor," said Shen Minggao, chief economist for Greater China, Citigroup.

Although the CPI is expected to fall more significantly in the fourth quarter, average inflation this year will almost certainly exceed 5 percent, overshooting the government comfort range of 4-5 percent, he said.

Liu Yuanchun, Associate Dean of the School of Economics at the Renmin University of China, expected the CPI to average at 5.2 percent this year.

He suggested the government avoid overusing administrative measures, such as bank loan quotas, and allow the markets to play a bigger role in combating inflation.

|