|

|

|

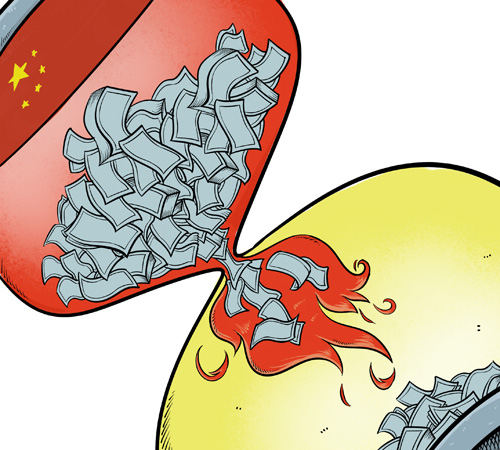

THROTTLING HOT MONEY: China vows to crack down on the influx of hot money through tougher rules aimed at uncovering shoddy trade data (CFP) |

Being a financier may not be the exclusive privilege of those working on Beijing's Financial Street and Shanghai's Lujiazui Area. Exporters in some remote towns are training themselves to become adept at moving cash. They are thoroughly conversant in the non-deliverable forward market in Hong Kong and the renminbi lending rate on China's mainland. A man surnamed Luo, who declined to provide his given name, was one of them. Channeling the U.S. dollars borrowed in Hong Kong at a low interest rate into a trade company is his long-practiced technique. After converting it into renminbi, he lent the money out at a higher interest rate. The ensuing profits have led him to shift his focus away from his own outdoor gear and supplies business in coastal Zhejiang Province.

Luo, confessing he used shady financial tools frequently last year, preferred not to reveal how much he earns from his trading practice.

Speculators like Luo are considered culprits in hot money inflow and have caused a growing headache for China's forex regulators. In a statement released on May 6, the State Administration of Foreign Exchange (SAFE) said it would increase scrutiny on exporters who channel money into the country disguised as trade payments.

Restless hot money inflows may worsen China's inflation risk and push the yuan to a new high, say experts.

Currency speculation

China's exports increased 14.7 percent year on year in April, beating a market consensus of 9.2 percent and March's 10 percent, government data showed. Export values increased 18.4 percent in the first quarter from a year earlier, a sharp acceleration from the 7.9 percent for all of 2012. While the numbers are encouraging, exporters themselves doubt the data. "With yuan appreciation and sluggish demand in Europe and the United States, it is hard for me to sustain the export business, not to mention expand it," Luo said.

China's trade used to increase at the same speed as other Asian economies, but since the fourth quarter of last year, trade growth has been higher, according to the China Business Journal. During January 2009 and August 2012, China's export growth rate was 4 percentage points higher than other emerging Asian economies, but the gap was widened to 11.3 percentage points in the last two quarters. The April figure "defies the weak trade data reported in other regional economies, suggesting capital inflow imbedded in trade remains unchecked," said Liu Ligang, chief ANZ China economist.

Exporters like Luo have been channeling money into the country disguised as trade payments. The increases were fueled to a large extent by speculative capital moving into China in the form of trade-related loans and other financing instruments. Unlike normal trade financing, such capital inflows were not backed by real transactions of goods and services and thus posed a threat to China's economic and financial stability.

"There is indeed a large amount of speculative capital flows. Nearly all companies we met admitted that they were conducting some form of interest rate arbitrage on the expectation of further yuan appreciation," said Yao Wei, a Hong Kong-based economist with Societe Generale SA told the Global Times.

Yuan appreciation and differences in interest rates are considered major incentives driving exporters toward phony trade. The yuan has now risen more than 4.8 percent since it was un-pegged from the U.S. dollar in June 2010, increasing 1.5 percent in value this year alone. Plagued by economic recession and a slow recovery, Europe, the United States and Japan have been implementing low interest rates to boost growth, which has also contributed to the hot money influx.

|