|

China's lifeline industries are largely dominated by the centrally administered SOEs, but the public has been long complaining about their low efficiency contrasted with the high welfare conditions they offer employees as a result of their monopoly status.

The Third Plenary Session of the 18th Central Committee of the Communist Party of China last November unveiled the boldest reform package since the 1990s, including actively promoting mixed ownership and raising non-state share in the economy. Sinopec has become the first SOE to deliver on that promise.

In February, Sinopec unveiled a plan to restructure its massive marketing business. The company said it would sell up to 30 percent of its marketing arm, in a multi-billion-dollar asset restructuring. The stake sale plan was the first time a centrally administered SOE shared lucrative business with private investors.

The marketing segment of the oil giant includes over 30,000 petrol stations—the world's largest fuel retail network—more than 20,000 convenience stores at those stations, over 10,000 km of oil-products pipelines and a total storage capacity of 15 million cubic meters across China. Revenue from the mega marketing asset amounted to as much as 35.1 billion yuan ($5.66 billion) in 2013.

Sinopec finished setting up a holding company for the marketing assets by the end of March and the company was put into operation on April 1. Auditing and evaluation of the newly formed company will be completed before the end of June and so a plan will be released to bring in capital from around by then. The restructuring process will be finished by the end of the third quarter.

Sinopec chairman Fu said the company's marketing business still has huge potential that has yet to be unlocked.

"Generally speaking, the price-to-earnings ratio of global oil companies' sales subsidiary is about 15 to 25. But the number is only eight for Sinopec, which fails to reflect our potential value. After allowing in private or foreign capital, this 'gold mine' will be uncovered," Fu said.

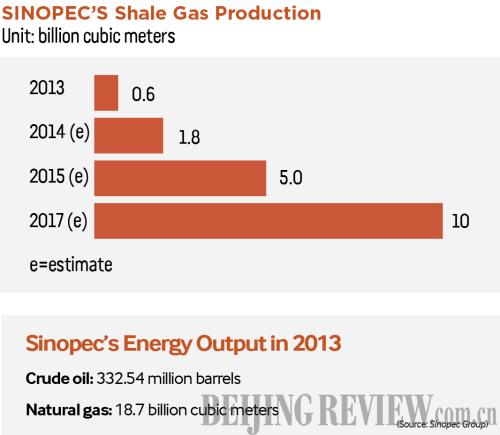

Fu said Sinopec will use funds raised from the sale to boost shale gas output and upgrade refineries.

Sinopec is seeking both domestic and foreign investors, preferably companies with sales experience in sectors other than energy, but priority will be given to domestic institutions as per the government's policy to share the dividend of China's economic growth, Fu said.

The aim of the restructuring is to boost the value of the low-margin marketing business, shore up the group's deteriorating finances and reinforce investment in exploration and production, analysts say.

It is not clear whether Sinopec would establish a partnership by setting up a joint venture or just absorbing money like through an initial public offering and put it into already established business.

Both ways are possible, said Xu Baoli, a researcher with the State-owned Assets Supervision and Administration Commission.

"Private investors may bring in industry expertise to run the marketing business in a more professional way, and help better SOE governance," said Xu.

Han Xiaoping, Chief Information Officer of China Energy Net Consulting Co. Ltd., said it is an initial step in a government-driven reform of SOEs.

The venture with Sinopec and domestic private companies will raise industrial efficiency, said Han. "Sinopec has advantages in the upstream refining business. It can establish partnerships with private companies where its refineries are located to save logistics costs," he said.

Experts say soliciting private participation is a wise move for Sinopec. Globally, most oil giants are shrinking their downstream strategies to focus on high-margin exploration and production activities.

"It is wise for Sinopec to scale back its downstream involvement by introducing outside investors and focusing more on the upstream sector, which can yield more profit," said Liao Na, Vice President of Shanghai-based energy consultancy ICIS-C1 Energy.

Liao, however, warned that private investors should be both active and cautious in investment decision-making because there are no details of assets provided for sale or the model for investment has not been specified.

"The large and medium-sized private companies and the ones which have already established cooperation with Sinopec have a greater chance of taking a piece of the pie."

Email us at: zhouxiaoyan@bjreview.com

|