|

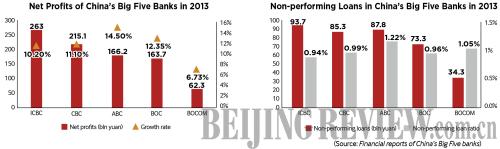

The newly added NPLs of the Big Five totaled 46.83 billion yuan ($7.6 billion) in 2013, much higher than the 10.95 billion yuan ($1.8 billion) in 2012.

Zong Liang, deputy head of BOC's international finance institute, said the rise in NPLs is inevitable when the country is facing housing market regulation, excess capacity and economic downward pressure.

"However, the industry-wide NPL ratio is within 1 percent, a relatively low level, said Zong. "Banks' NPLs are closely connected to the Chinese economy. As long as the economy sees growth, the NPL risk is under control."

Wang Tao, an economist with UBS Securities, said a great number of trust funds and wealth management products are due to mature within the same period of time. That, combined with a slowing economic growth rate, will bring about redemption crises or even defaults in Chinese banks in years to come. "However, a systematic financial crisis is unlikely to occur," Wang said in a research note.

The Big Five's annual reports to bourses show that NPL rise mainly appears in certain districts and sectors—areas including the Yangtze River Delta and Pearl River Delta and sectors including retail, wholesale and manufacturing.

Risks also come from local government financing platforms, housing loans and loans to sectors with overcapacity, such as cement and iron.

Qu Hongbin, chief economist with the HSBC, thinks observers shouldn't be overly pessimistic about the quality of China's banking assets. "Judging from the array of reform measures China has adopted, China is totally capable of squeezing out the asset bubbles and realizing a soft landing."

Online challenges

Ever since Yu'ebao (literally meaning "leftover treasure"), an online investment product provided by Alibaba Group, China's e-commerce leader, was launched in June 2013, online investment products have taken off in China, posing a potential threat to traditional banks as more and more spare cash has been transferred to those online financial platforms from traditional banks.

With its attractive yield, better flexibility and fewer restrictions, Yu'ebao was an instant hit. Many Chinese Internet companies followed suit and developed similar financial services, including search engine giant Baidu, instant messenger developer Tencent and the e-commerce arm of electronics retailer Suning.

The Big Five are on the go to guard their territory. In their annual financial reports, challenges from online financial products were frequently mentioned, as well as their overall business layout to take on those challenges.

As a defense, they lowered their daily ceiling of money that can be transferred from their bank accounts to those online investment platforms. They also proactively developed their online business products, such as e-bank, banking service apps for mobile phones and banking services via WeChat, a mobile text and voice messaging app developed by Tencent. They've also released similar products to Yu'ebao.

For instance, as of the end of 2013, the ICBC had 160 million e-banking service users, over 130 million mobile banking app users and 80 percent of transactions are conducted online.

Hou Weidong, Vice President of BOCOM, said Internet companies' push into the financial service sector could be complementary to traditional banks' services, although they may pose a potential threat to traditional institutions.

"Internet companies have the gene of innovation, which creates new impetus for traditional commercial banks to innovate and to reflect on their traditional business models. Facing pressure, traditional banks will actively innovate and play up their advantages."

Hou argues traditional banks still boast many advantages that Internet companies fall short of.

"We have a complete risk management system, which is helpful for stabilizing the online financial market. Also, after decades of online business development, banks have accumulated a number of talented people that are both familiar with finance and Internet applications. These are the advantages that non-financial institutions can hardly achieve in a short period of time."

Email us at: zhouxiaoyan@bjreview.com

|