|

How to survive

Some experts warned that the public should not be overly optimistic toward the future of private banks. "Since state-owned commercial banks still hold the bulk of the deposits in the country, private banks will be squeezed by their state-owned counterparts' advantage of low financing costs," said Zhong Wei, Director of the Financial Research Center of Beijing Normal University.

Zhong suggested that private banks develop their own advantages in enhancing their service quality.

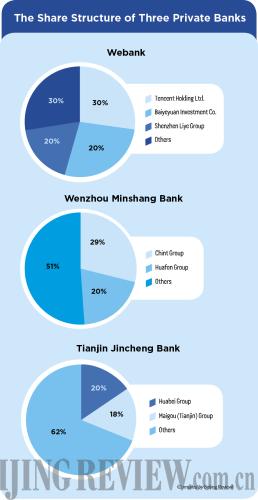

Yang Liping, an official from the CBRC, pointed out that the three banks have been established on the basis of the market demands of the regions in which they are located and the expertise and advantages enjoyed by their shareholders. "Different financial institutions are encouraged to formulate development strategies according to their individual characteristics, rather than attempting to be all things to all people," said Yang.

Owing to the participation of Tencent in the preparations, it is widely believed that new ideas and approaches from Internet finance will be introduced into the banking sector.

Wang Ting Ting, a finance professor at the Central University of Finance and Economics, noted that Tencent's edge lies in its ocean of existent clients. "As Tencent expands its business in financial services and products, its enormous pool of clients will prop up its physical bank," said Wang.

The prospective private bank in Wenzhou has decided to follow the strategy of "taking root and serving businesses in Wenzhou," in the hopes of seizing a foothold in the local banking industry.

"Since the shareholders of the bank in Wenzhou enjoy a deeper level of knowledge regarding local conditions, it will take fewer resources for them to carry out credit investigations and serve local companies," said Xu of Chint Group, who argued if the bank can give a full play to its advantages in terms of geographic location, decision-making mechanisms and information costs, and continue to provide small and micro companies with innovative financial products, a core competitiveness will gradually take shape.

Yang Zaiping, Vice President of China Banking Association, held that what private banks need is a transparent, stable and equal environment with both penalties and supporting policies.

"The traditional financial sector is policy-oriented. Private banks are dependent on policy environment as much as their state-owned counterparts," said Zhong, noting that risk management is pivotal to the success of private banks.

Ensuring safety

Without the support of government credibility and the deposit insurance system, worries have arisen over private banks' ability to guarantee the safety of deposits.

The founders have agreed to run the banks entirely at their own risk. Given the absence of a deposit insurance system, if a private bank has to go through bankruptcy liquidation and its capital can't pay off debts, the net asset of its actual controllers will be used to fully or partly return the money to depositors, Yang Liping explained.

Zhong expressed strong confidence in the risk management ability of the approved three banks owing to their good financial standing, though he warned of potential problems of a similar nature in the future. "As the thresholds for private banks become lower in the future, problems may inevitably rear their ugly heads."

As Yang Liping suggested, the CBRC has set about drawing up supervisory regulations for private banks and designated special institutions and agencies to oversee related business activities, especially the potential connected transactions between these banks and their founders.

"The deposit insurance system is expected to be launched this year. Then worries over deposit safety will be alleviated," said Guo Tianyong.

Email us at: dengyaqing@bjreview.com

|