|

Twin trade-related challenges to China's Africa strategy

At the turn of the century, Africa was struggling to participate fully in the fast moving globalised world. Fortunately, China-Africa trade increased from $8 billion in 1990 to $106 billion in 2008, doubling in nominal terms every three years. Today, China accounts for more than one-tenth of Africa's trade, playing a critical role in doubling Africa's share of world trade from 1.7 percent in 2001 to 3 percent in 2008. Impressively, China-Africa trade has proven resilient to the global recession, declining by 14 percent year on year from $106.8 billion in 2008 to $90.5 billion in 2009. Furthermore, excluding China's bilateral trade with Angola, which declined from $26 billion to $4 billion over the last year, Sino-African trade declined by a mere 8 percent, amidst great global macroeconomic uncertainty. In contrast, Africa's trade with the more mature partnerships of Japan, U.S. and France declined by 45 percent, 39 percent and 22 percent year on year, respectively. Promisingly, the decline in international trade reached an inflection point towards the tail end of 2009, which has infiltrated industrial production and economic activity across the globe that will, in time, support income. However, a few important concerns regarding China-Africa trade exist.

Africa only exports minerals and energy to China

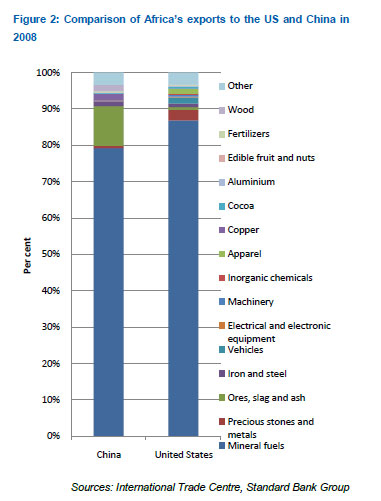

Challenge: Many argue that Africa's exports to China reflect a disproportionately large share of raw material minerals, implying that Sino-African trade has limited meaningful positive domestic multipliers for Africa.

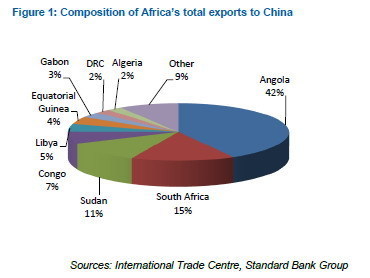

African exports to China have experienced a particularly swift advance, from less than $1 billion 1992 to over $54 billion in 2008. (Africa's exports to China declined to $43 billion in 2009.) The Chinese economy is energy intensive and in the fairly nascent stages of its own industrialization. Nearly 80 percent of China's imports from Africa comprise mineral fuels and oils. Therefore, it is logical that 60 percent of Africa's exports to China come from the continent's oil flushstates.

While undeniably large, the share of commodities in Africa's exports to China is not specific to Sino-African ties. Consider that the share of mineral fuel exports in Africa's total exports to the U.S. was 87 percent in 2008 and 85 percent in 2009. In the case of Germany, the share of mineral fuels was 61 percent in 2008 and 56 percent in 2009, but adding ores, precious stones and other metals takes the share of commodities past 70 percent. In addition, 64 percent of Africa's total exports are made up of mineral fuels. Hence, the disproportionately large share of commodities is consistent across the majority of Africa's major trading partners, reflecting both Africa's resource abundance and dearth of higher value goods.

China adds diversity and resilience to Africa's economic thrust and global emergence. The increased demand for Africa's resources should thus be welcomed, as it offers diversity in bilateral relations. In 2009, African exports to China declined by 22 percent year on year to $43.2 billion. However, relative to Africa's other key trade partners, the fall was small and expected, owing to a broad-based decline in Africa's commodity exporter's terms of trade. For instance, Africa's exports to Japan, the U.S. and France declined by 56 percent, 45 percent and 30 percent year on year, respectively.

It is clear that Africa must reduce its unsustainable reliance on commodity exports as this heightens the continent's sensitivity to swings exogenously determined forces. However, to some extent, the criticism that China is only interested in Africa's natural resources misses the crucial point that, at present, natural resources remain Africa's core advantage in global trade. Africa must capture elevated global commodity demand to secure revenues. The management and allocation of the revenues collected from the sale of natural resources should generate large domestic multipliers by scaling up value-add industries; broaden industrial capacity; diversify exports; and develop social, economic and human infrastructure. Responsible decisions will inevitably lead to a rebalancing of trade with China and the rest of the world.

|