|

|

|

(CFP) |

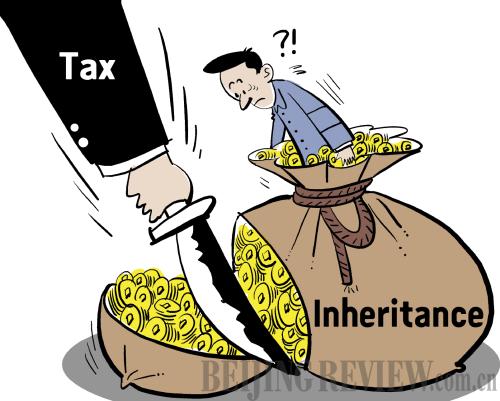

How does Chinese society treat the rich? When it comes to passing down wealth through family, people can leave all their personal belongings to heirs and the recipients do not need to pay a penny of tax for their inheritance to the state, unlike what is required in many other countries.

However, pressure for change is emerging despite huge controversies.

On September 23, the 21st Century Business Herald, a business newspaper published in Guangzhou, Guangdong Province, said that the country's top leadership was considering the introduction of inheritance tax. The report cited Liu Huan, a State Council counselor and professor at the Central University of Finance and Economics in Beijing, as saying that a draft of the proposal had already been submitted for discussion at the Third Plenary Session of the 18th Central Committee of the Communist Party of China (CPC). The meeting was held in Beijing on November 9-12 to discuss and lay out plans for comprehensive reforms in the country.

Although Liu, in a statement on October 1, clarified that he did not make the announcement and had not participated in the preparation of or read any documents for the Party session, the issue of inheritance tax has already become a popular topic of discussion online and among media outlets.

According to Sina Weibo, the most popular micro-blogging service in China, within a week after the 21st Century Business Herald's report, more than 1 million posts discussing inheritance tax were published. Many expressed concerns that the tax may risk stifling the country's emerging middle class.

Concerning the sudden burst in debate, multiple tax experts responded separately, stating that China is unlikely to introduce inheritance tax in the near future due to current difficulties.

"Implementing inheritance tax requires not only technical, but also social preparation," said Shi Zhengwen, Director of the Research Center for Fiscal and Tax Law of China University of Political Science and Law in Beijing. According to him, the mature system needed to assess the value of inherited assets, including personal or movable property and real estate, does not yet exist in China.

In the works

Inheritance tax concerns both any levy paid by a person who inherits money or property and also any tax on the estate of a deceased individual. "Its basic aim is to create social fairness by balancing wealth distribution within society and narrowing the gap between the rich and poor," Shi said.

Inheritance tax was allegedly considered by the state leadership as early as 1993. At that time it was considered a way of promoting China's market economy, but it was eventually decided that it would not be put into practice.

China's 10th Five-Year Plan (2001-05) also proposed levying the tax then. In 2004, a draft regulation for inheritance tax was rolled out by the Ministry of Finance, but was ultimately not implemented.

In 2008, the Ministry of Finance revealed it was researching the possibility of an inheritance tax, saying that, based on the experiences of other countries, the tax could help boost social programs.

Two years later, a revised version of an inheritance tax draft became available in 2010 and provided more details, including a proposed tax threshold of 800,000 yuan ($131,120) and different tax rates varying from 20 to 50 percent based on the value of the inheritance. However, the draft also failed to be accepted, allegedly due to the lack of necessary asset declaration provisions and systems.

Before this latest debate over inheritance tax began in September, a document issued by the State Council, China's cabinet, in February again proposed introducing an inheritance tax at the "appropriate time."

In addition, there were two research reports in favor of such a tax that were published earlier this year.

In the first report, Feng Qiaobin, a professor at the Department of Economics of the Chinese Academy of Governance, stated that China's economic development has laid foundation for levying inheritance tax, and the growing gap between the rich and poor has made the tax more necessary than before.

A Peking University survey found that in 2012, the bottom 25 percent of China's households accounted for just 3.9 percent of total national income, compared with 59 percent for the top 25 percent of earners.

|