|

"Among the world's major economies, Chinese exports were the most targeted by trade protectionism. Emerging economies are also increasingly launching trade investigations against China, while the number of targeted industries is rising," said Zheng. Chinese exporters were targeted by 72 trade investigations in 2012.

December's exports rose by a seven-month high of 14.1 percent and imports increased by a six-month high of 6 percent, both higher than market expectations.

But the rebound in December was a result of a lower comparative base from 2011 and improving orders following holiday shopping seasons in foreign countries, said Liu Junyu, an analyst at China Merchants Bank. The trade outlook for the first half of 2013 will remain dim, he said.

Inflation, which used to be an acute headache for the Chinese economy, was within government control in 2012. However, long-term inflationary pressure still exists. Monetary policies must be rolled out with full caution to avert the re-ignition of a price spiral.

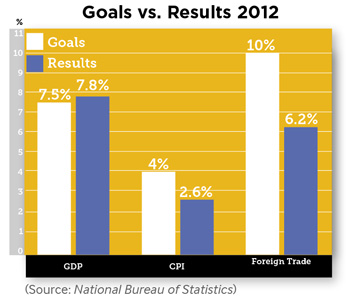

The consumer price index (CPI), a main gauge of inflation, rose 2.6 percent in 2012, well below the government's annual target of 4 percent, said the NBS.

Inflation saw a moderate rebound in recent months due to surging food prices, which was the result of a 28-year-record cold winter.

Wang Jun, an expert with the China Center for International Economic Exchanges, said that China will face greater inflationary pressure in 2013 than in 2012.

"Inflation is likely to rise in the coming months as a result of rising food prices and higher labor and land costs, the quantitative easing measures in foreign countries and stabilizing domestic economic growth," Wang told Xinhua News Agency.

"Recently, lots of risks were exposed in China's trust and money management market. Also, with the outcome of the fourth round of quantitative easing in the United States and rampant liquidity in the world, China still faces lots of inflationary pressure," said Guo Tianyong, a professor at the Central University of Finance and Economics.

The government should stay alert against inflation, but hyperinflation in 2013 is unlikely to occur, Wang said. He predicts the CPI will stay 3-4 percent in 2013.

In order to prop up growth, the central bank cut the reserve requirement ratio twice in 2012 and also lowered its benchmark interest rates twice over the course of the year.

"The government should continue to keep a prudent monetary policy in 2013, and adopt a more proactive fiscal policy and extend tax cuts to stabilize economic growth," Wang said.

Overcapacity is another challenge, a persistent situation worsened by dwindling foreign orders, according to Lian.

"Continuous sluggish economic recovery in developed countries suppressed China's exports, adding to overcapacity in the country," said Lian.

Email us at: zhouxiaoyan@bjreview.com

|