|

|

|

ABANDONED COMMUNITY: Some unfinished apartment buildings stand deserted in Kangbashi New Area of Ordos, Inner Mongolia Autonomous Region in September 2012 (XINHUA) |

Huang Lichong, President of Synergy Capital, told National Business Daily that rumors about property tax is another reason. Once the property tax is put into practice, the cost to own a house would rise, and real estate investment would be less lucrative, resulting in weak demand.

The long term

Overall, China's housing market has experienced explosive growth since 2003. In fact, the Chinese Government has taken steps to cool off the market since 2005 through strict credit controls and increasing interest rates and down payments. Since then, the government has unveiled an array of policies to regulate the housing market, but each year they haven't worked.

"The skyrocketing prices in first-tier cities as well as the plunge of the housing market in Wenzhou tell us that a long-term mechanism is needed to prevent housing prices from a return to the era of speculation or a collapse that could undermine the economy," said Wang Yong, an analyst with CITIC Securities.

Zhu Zhongyi, Vice President of the China Real Estate Association, argues that the mechanism should include improving regulatory policies and strengthening government-subsidized housing programs in terms of financing and allocation.

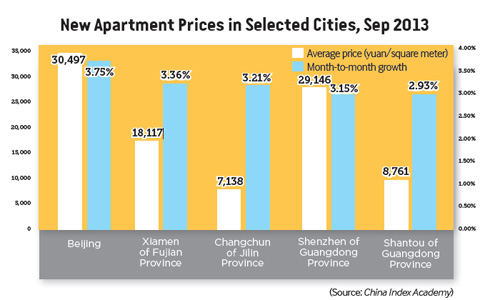

A report from the China Index Academy shows that China's real estate market is undergoing polarization and the trend is more and more conspicuous. Rigid demand is strong in some big cities, and optimistic expectations have led to an increase in the amount of prime land designated for real estate development. Given that the upward pressure in first-tier cities is still mounting, more effort is needed to regulate and control the housing market, experts say.

The situation is different in some other cities, where the economic climate is gloomy and housing prices are stagnant. Local governments in cities like Wenzhou, Zhoushan and Jinhua of Zhejiang, and Zhuhai of Guangdong Province have set out to vitalize the real estate market by loosening the home purchase limits.

The Central Government should also speed up land reform plans and build more affordable housing projects, experts say. Only then can the real estate market achieve a healthy and sustainable development.

Email us at: lanxinzhen@bjreview.com

|