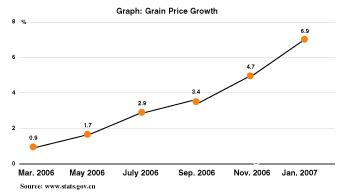

TO THE POINT: China's trade surplus boomed again in January, crippling the Ministry of Commerce's efforts to curb the surplus and rebutting Western countries' criticism of the yuan exchange rate. Even though the Chinese currency appreciated 3.7 percent last year, the trade surplus still rose. As China suggested, expanding imports seems to be key to cutting down the surplus. Meanwhile, China continues to be favored by foreign direct investment (FDI). Instead of building factories and establishing manufacturing centers, experts suggest mergers and acquisitions be the new trend for FDI. Real estate came under the spotlight once again as the land value-added tax was imposed on developers, who swiftly passed the buck to ordinary consumers, leading to price hikes. Chinese mobile phone producer CEC formally acquired Philips' handset business. Judging by the previous failures in transnational handset acquisition conducted by two Chinese companies, insiders strongly doubt the prospects of this new deal. The consumer price index (CPI) continued to increase in January, but with a narrowed growth rate, dispelling the worry about inflation. However, the grain price is skyrocketing, which is considered the main driving force of CPI.

Can Yuan Appreciation Really Help?

According to the General Administration of Customs, China's trade surplus in the first month of 2007 hit $15.88 billion, dropping remarkably from $21 billion last December but still a 65 percent hike compared with the same month in 2006.

Western countries, especially the United States and the European Union, have been grumbling over the Chinese undervalued yuan, and have been sparing no efforts in pushing China to appreciate its currency. Yuan appreciated 3.7 percent last year.

However, the trade surplus in January proved that yuan appreciation won't help a lot in narrowing the Chinese trade surplus, according to Shen Danyang, Vice Director with Chinese Academy of International Trade and Economic Cooperation (CAITEC), a research and advisory arm affiliated to the Ministry of Commerce.

The Chinese Government has taken a series of measures to curb the excessive trade surplus, such as scrapping export tax rebates in some high-pollution and energy-consuming sectors.

"I don't think the surplus will sharply decline this year, say by 50 percent," said Mei Xinyu, another trade expert with CAITEC.

It's up to other countries like the United States to export more to further alleviate surplus problems-and that might be happening.

According to an Associated Press report, the Bush Administration on February 12 said two U.S. companies, Morris Township and Honeywell International Inc., could export rail and aerospace equipment to China, adding that national security would not be threatened by such trade.

Another Mobile Acquisition

|