|

|

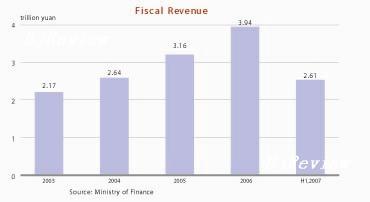

TO THE POINT: On the heels of the release of the country's first-half macroeconomic statistics came news of two macro-control measures-an interest rate hike and an interest tax cut. The measures were simultaneously announced by the central bank and the State Council, and are seen as moves to target the surging consumer price index (CPI) and alleviate inflationary pressure. However, since the government moves were expected earlier, public investors' enthusiasm wasn't affected and the stock market rallied instead. The real estate market is as blistering as the summer heat, but some experts don't think the newly released measures will cool the market. In the background of the booming national economy, fiscal revenue also reached a record high during the first half of this year. But the finance minister cautioned that tax revenue generated from the sizzling stock and real estate markets has abnormally boosted the surge in fiscal revenue. China's major policy bank, China Development Bank, will purchase a 3-percent stake in Barclays, as a helping hand to the latter in its bid for Dutch bank ABN Amro. Both sides are seen to benefit from the deal, as the British bank brings its management experience and expertise to its Chinese partner.

By YU SHUJUN |

Resolute on Curbing Inflation

Amid wide expectations, the central bank finally raised the benchmark one-year deposit and lending interest rates of commercial banks by 0.27 percentage point on July 21. Meanwhile, the State Council has decided to cut the withholding tax on interest income from 20 percent to 5 percent as of August 15.

The two measures were announced on the same day after the first-half economic statistics were published, indicating the government's resolution to curb inflation and stabilize prices. CPI, a key indicator of inflation, rose 3.2 percent during the first half and grew over 3 percent for four months (3.3 percent in March, 3 percent in April, 3.4 percent in May, and 4.4 percent in June.)

This interest rate hike was the third this year. It raised the one-year benchmark deposit rate to 3.33 percent from 3.06 percent. The one-year lending rate rose to 6.84 percent from 6.57 percent. The interest rate on demand deposits was also increased from 0.72 percent to 0.81 percent, which has not been seen since 2002. In addition, the 15-percentage point tax reduction on interest income equals a 0.5-percentage point hike on the one-year deposit interest rate.

Experts say the recent moves are far from enough and more restrictive macro-control measures are expected to come out in the second half of the year. Many experts consider there are possibilities of more interest rate hikes, as the CPI's climbing trend led by rising food prices is expected to continue for several months.

Tao Dong, Chief Economist of the Asia-Pacific region with Credit Swiss First Boston, estimated that the interest rate might be raised twice before the end of the year since China's real interest rate can't stay at a negative level for a prolonged time.

Faced with the cooling measures, the stock market responded inversely, as stock investors were reassured when "the other shoe"--the interest rate hike they had been waiting for--finally dropped.

On July 23, the first trading day after the interest rate hike, the benchmark Shanghai Composite Index surged 3.81 percent to close at 4,213 points. After a slight decline of 0.07 percent the next day, the index closed at 4,324 points on July 25, approaching the peak 4,335 points. Analysts speculate that the market correction that began on May 30 might soon draw to a close.

Fiscal Revenue Hits Record High

In the first half of this year, China's fiscal revenue grew 30.6 percent year on year to 2.6 trillion yuan ($1=7.56 yuan), according to statistics released by the Ministry of Finance (see graph).

This amount accounts for 59.3 percent of the year's revenue budget, with 1.45 trillion yuan belonging to the Central Government, up 32.6 percent year on year, and 1.16 trillion yuan belonging to local governments, up 28.1 percent from a year ago.

|