|

Numbers of the Week

20.5 billion yuan

The country's "new-for-old" home appliance scheme had generated 20.5 billion yuan ($3 billion) in revenue and recycled 5.721 million old appliances by January 24, according to the Ministry of Commerce.

4.3%

The urban registered unemployment rate stood at 4.3 percent in 2009, according to the Ministry of Human Resources and Social Security.

TO THE POINT: An inexplicably high loan volume in January forced regulators to control loan issuance in the market. The Chinese Government focused on building competitive state-owned enterprises (SOEs) in the hotel industry by ordering non-hotel-related SOEs to retreat from the hospitality business by selling and transferring their shares. The government also vowed to develop the domestic movie industry by giving financial support to moviemakers in the wake of a boom in box office sales in 2009. The big is getting bigger, as the 2009 GDP composition revealed that China's top three provinces contributed one third of the Chinese economy. The mainland retail market is now filled with international retailing conglomerates that will only increase their share of the Chinese market in time. Geely is set to embark on an expansion after acquiring Ford Motor Co.'s Volvo brand. The shipbuilding industry fared well last year as reflected in the sector's strong sales revenue.

By LIU YUNYUN

Loan Restraints

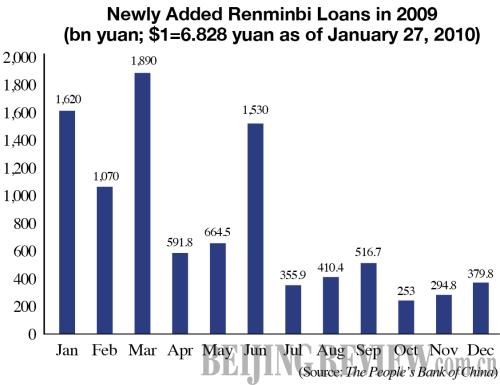

Skyrocketing loans in the first month of 2010 triggered anxiety over financial stability among regulators. The China Banking Regulatory Commission ordered commercial banks to rein in loans and control the speed of loan issuance.

China's leading business newspaper 21st Century Business Herald cited a bank insider who stated that by January 19, 2010, newly added renminbi loans had surpassed 1.45 trillion yuan ($212 billion), almost reaching 1.62 trillion yuan ($237 billion)—the level of the total new loans in January 2009.

Although the Central Government agreed to maintain its relatively loose monetary policy this year, it certainly will not allow the banks to behave in such an out-of-control manner. Concerns are whether the loans have gone to the real economy instead of stock and property market speculation.

In some banks, personal housing loans accounted for a major proportion of new loans, since house prices have surged since the middle of 2009. For instance, prices at Helifang, a loft project in north Beijing, rose 5,000 yuan ($732) per square meters and is now 21,000 yuan ($3,074) per square meter. The phenomenon of chaolouhua—selling an apartment after the purchase contract is signed but without getting the official ownership document—becomes trendy as the housing price increases day by day.

The recent tightening messages sent the stock market plunging—from January 19 to 27 the benchmark Shanghai Composite Index dropped 8 percent to 2,986.61.

Hotel Consolidation

SOEs under Central Government administration (central SOEs) will pull back from the hotel industry in succession in the next five years, according to a regulation issued by the State-Owned Assets Supervision and Administration Commission of the State Council on January 25. At present, the 129 central SOEs manage more than 2,000 hotels with a total value exceeding 100 billion yuan ($14.6 billion).

The central SOEs that do not run hotels as their main business are not permitted to build new hotels and are required to dispose of their current hotels in the next three to five years. Their options include selling their hotel assets or transferring the assets through purchase agreements or open market operations to central SOEs whose business is focused on the hotel industry.

Analysts said the efforts were meant to make hotel-focused central SOEs stronger and more competitive in the domestic market. Currently in metropolises such as Beijing and Shanghai, the high-end hotel business is carved up by overseas hotel tycoons, such as the French Accor and the Malaysian Shangri-la Asia Ltd.

Some central SOEs have already started the asset sale and transfer process. According to the Beijing News, the core assets of 200-plus hotels under the management of China National Petroleum Corp. have been transferred to its subordinate company, Soluxe Hotel Group, which now owns over 60 hotels.

|