|

"But liberalizing the interest rates is a complicated long-term process and requires greater efforts to solidify the health of the financial markets and strengthen risk controls," he added. "So a temporary and safer solution is to unilaterally raise the deposit rates or cut the loan rates."

"Besides, it is also necessary to propel the capital markets, such as stock and bond markets, and wean off reliance on bank credit as the biggest source of financing," added Guo.

In the United States, the interest margin is even bigger than that in China, but their banks are still operating on modest profits. "The reason is that banks only contribute one third to overall financing, well below the ratio in China."

Although intermediary business remains a weak point for Chinese banks, the fast increasing items of fees and excessive charges have aroused severe criticism, with consumers complaining about being charged for everything from transferring funds to changing Internet banking passwords. The most common complaint is that customers of a bank in one city are charged a fee when using the ATMs of the same bank in a different city.

In July 2011, a report from the China Banking Association said there were a total of 1,076 service items in China's banking sector, 79 percent of which were charged fees.

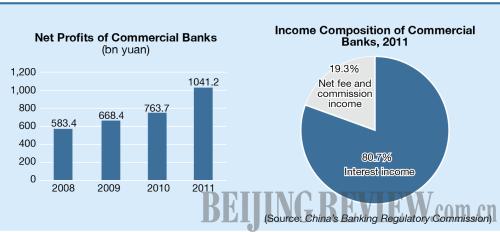

In 2011, Chinese commercial banks earned 514.9 billion yuan ($81.7 billion) in net fees and commission income, leaping 46.3 percent from the previous year, said the CBRC.

Wang Yunsheng, a 28-year-old private business owner in Shanghai, is one of the many bank customers upset by the unscrupulous charges. "I invested a large part of my savings in a variety of wealth management products of a state-owned commercial bank in a move to offset the impact of inflation," he told Beijing Review. "But sometimes the gains of the investments were not even enough to pay the heavy charges, such as the asset management fees."

The fee problem has also exacerbated financial burdens on enterprises. "When we extend loans to banks, the lending rate is around 7 percent. But the actual financing cost may exceed 12 percent if all kinds of commissions and consulting fees are factored in," an anonymous manager of a commercial bank in Jiangsu Province told 21st Century Business Herald.

Yang Zaiping, Vice Chairman of the China Banking Association, said the unregulated fees, some of which are even illegal, have been one of the drivers for soaring profits at banks.

"Commercial banks are encouraged to promote the intermediary businesses and diversify away from interest income," he said. "But that does not mean the banks are allowed to hurt the interests of consumers."

"It is imperative for banks to make their charges more transparent and fulfill their social responsibility by providing more free services," he added.

Government efforts to regulate banking fees are already underway. The CBRC, PBOC and the National Development and Reform Commission jointly released new rules in February to streamline the chaotic sector.

The banks must give a three-month advance notice to clients of an increase in service prices, according to the draft regulations. In addition, customers must be informed one month in advance if the banks want to charge them for a new item. The government will set or guide charges on some basic services such as fund transfers and payment collection.

The government is also launching a nationwide investigation to clear illegal banking fees. Zhao Xijun, Deputy Director of the Financial and Securities Institute at the Renmin University of China, pointed out that a root cause of the fees is a lack of competition. "So a more permanent countermeasure is to further open up the banking industry and encourage competition," he said.

Email us at: huyue@bjreview.com |