|

Overview

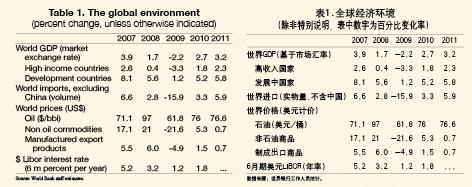

In spite of the global recession, China's economy grew 8.7 percent in 2009. Massive investment-led stimulus was key, but real estate investment gained prominence more recently and household consumption growth has held up very well. The domestic growth momentum continued in the first months of 2010. Exports declined in 2009 as a whole, even as China gained global market share. With imports strong, external trade was a major drag on growth in 2009 and the external current account surplus declined sharply. Exports rebounded strongly through 2009, though, and exceeded the pre-crisis level in early 2010. In a heated real estate market, surging property prices triggered policy measures to expand supply and curb speculation.

We project 9.5 percent GDP growth for this year, with a shift in the composition. Government-led investment is bound to decelerate. But, exports are likely to continue to recover amidst a pick up in the global economy and real estate activity is likely to grow strongly this year. Consumption growth should remain solid. Inflation is on course to be significant in 2010, after being negative in 2009. But, with global price pressures likely to be subdued amidst large spare capacity internationally, China's inflation is unlikely to reach high rates in 2010. We expect the external surplus to remain broadly unchanged this year.

The macroeconomic policy stance needs to be tighter than in 2009. Unlike in most other countries, overall output in China is close to potential. Thus, China needs a different macro stance than most other countries. Macroeconomic risks include a property bubble and strained local government finances. The 2010 budget rightly implies a broadly neutral fiscal stance. Given the remaining uncertainty about the world economy, flexibility in its implementation is important. Inflation expectations can be contained by a tighter monetary stance and a stronger exchange rate, while monetary policy also has a key role to play in containing risks of asset price bubbles. The case for a larger role for interest rates in monetary policy is strong. If policymakers remain concerned about interest rate sensitive capital flows, more exchange rate flexibility would help.

Ensuring economic and financial stability includes mitigating risks of a property bubble and strains on local government finances. With regard to the property market, stability calls for an appropriate macro stance and improving the functioning of markets. Concerns about the affordability of housing for lower income people would be best addressed by a long term government support framework. The central authorities have rightly increased vigilance over lending by local government investment platforms. Given China's solid macroeconomic position, the local finance problems are unlikely to cause systemic stress. But the flow of new lending to the platforms needs to be contained and local government revenues need to become less dependent on land transaction revenues.

In the presentations to the National People's Congress (NPC), the government emphasized the need for structural reforms. As China is preparing for the 12th Five Year Plan, the key overall objectives are making further progress in "rebalancing" the economy, enhancing efficiency gains, moving to a more sustainable spatial transformation of economic activity and employment, further changing the role of the state in the economy, and taking account of China's interaction with the rest of the world.

Recent economic developments

In spite of the global recession, China's economy grew 8.7 percent in 2009. Growth decelerated significantly in end 2008 and early 2009 as exports collapsed amidst the global recession (Figure 1). But, China's massive stimulus package kicked in in the second quarter of 2009. We estimate that quarter on quarter gross domestic product (GDP) growth peaked in the second quarter and moderated to an average 10 percent in the second half (seasonally adjusted annualized (SAAR)), bringing year on year (yoy) GDP growth to 10.7 percent in the fourth quarter.

China's robust growth in 2009 was the result of massive investment-led stimulus. The stimulus has been centered on infrastructure spending, combined with increases in transfers, consumer subsidies and tax cuts. The surge in government-led spending was equal to 5.9 percent of GDP in 2009. However, only a small part of the stimulus was reflected in the budget, with the deficit rising from 0.4 percent of GDP in 2008 to 2.8 percent in 2009. Additional financing—largely bank lending—contributed almost two-thirds of the stimulus. The bank lending towards infrastructure projects run by local government investment platforms has been a key part of the massive monetary expansion that brought total net new bank lending to 9.6 trillion yuan in 2009, or almost 30 percent of GDP. Nonetheless, the lending surge was actually fairly broad based (Figure 2). Infrastructure made up one-half of total medium and long term lending in 2009, compared to one-third in 2007. Medium and long term lending to manufacturing, real estate (including mortgages) and other sectors also soared by more than 100 percent. The share of total new lending going to households, notably mortgages, increased from 14 percent in 2008 to 26 percent in 2009.

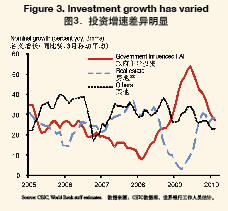

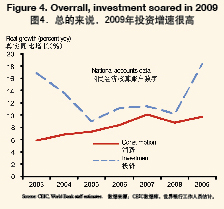

Government-led investment was the key driver of growth for much of 2009, but real estate investment gained prominence more recently. Estimated government-led investment surged 42 percent in 2009, in nominal fixed asset investment (FAI) terms, compared to 18 percent growth of market based FAI.[1] However, by the end of 2009 and in early 2010, government-led investment growth was coming down considerably (yoy) (Figure 3). Real estate investment was very weak in early 2009. But, fueled in part by ample liquidity, housing sales recovered in early 2009 and the real estate sector heated up, with prices rising rapidly in many cities.[2] As a result, real estate investment rose rapidly in the second half of 2009. Growth in other market based investment has trended down since mid-2008. In all, investment rose around 18 percent in 2009 in real terms, on a national accounts basis, the fastest growth since 1993 (Figure 4).[3]

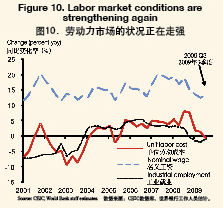

Household consumption growth has remained steady. After weakening in early 2009, labor market conditions improved and employment and wage growth have held up well through early 2010. Incomes and consumption were further supported by falling consumer prices for much of 2009 (which boosted purchasing power); higher government transfers; and other measures such as lower consumption taxes for small cars and subsidies for rural consumption of electronic appliances. With government consumption also up substantially, total consumption rose by an estimated 9.7 percent in real terms in 2009.

The domestic growth momentum broadly continued in the first months of 2010. Growth of monetary aggregates and investment growth started to ease somewhat in late 2009. After a rush of lending in the first weeks of 2010, the government took measures to contain the pace of lending and loan growth slowed to 27.2 percent (yoy) in February. However, consumption did not slow in early 2010. Retail sales grew 15 percent in the first two months of 2010, in real terms, compared to a year ago.

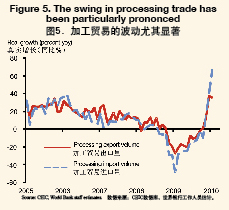

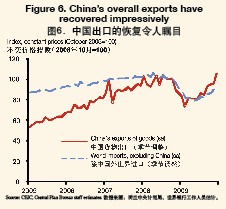

After a sharp fall early in 2009, exports recovered briskly, sequentially, as China gained global market share. With processing exports particularly hard hit by the global crisis, China's exports initially fell even faster than the imports of its trading partners (Figures 5 and 6). However, as the global economy improved, exports staged an impressive recovery, with processing exports rebounding particularly rapidly. For 2009 as a whole, we estimate that China's exports of goods and services fell 10.6 percent, in real terms. This compared to a fall in world imports (excluding China) of 16 percent, in real terms. Thus, overall, China's exporters have continued to gain market share in 2009. The export rebound continued into 2010 and in the first two months of this year exports (in U.S. dollar terms) exceeded the 2008 level.

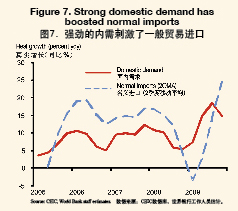

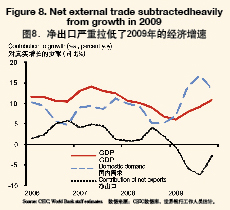

With imports strong, external trade subtracted heavily from growth in 2009. Processing import volumes tracked processing export volumes (Figure 5) while normal, non processing imports were boosted by the strong domestic demand (Figure 7). Combined, economy-wide imports rose an estimated 3.9 percent in 2009. For the year as a whole, net external trade subtracted 3.9 percentage points from GDP growth, although this contribution improved later in 2009 and early 2010 (Figure 8).

The current account declined sharply in 2009 but reserve accumulation continued apace. The trade surplus declined from $361 billion in 2008 (8 percent of GDP) to $243 billion in 2009 (5.1 percent of GDP) as import volumes held up while export volumes fell. It would have fallen more if the terms of trade had not improved substantially, with raw commodity prices falling much more than prices of manufactured goods. In addition, the services balance, the net income balance, and net transfers all fell in 2009. As a result, the current account surplus declined from $426 billion (9.4 percent of GDP) in 2008 to $284 billion (5.8 percent of GDP) in 2009. Inward FDI was weak in early 2009. It picked up as the international economy stabilized, but, with outward FDI substantial, net FDI declined significantly, to $37 billion. On a net basis, financial capital inflows (called "hot money" in China) were $73 billion in 2009. Including also some positive valuation effects, foreign reserves increased by $453 billion to $2,399 billion last year.

The overall importance and structure of China's external trade has changed in recent years. Gross exports were 27 percent of GDP in 2009, compared to a peak of almost 40 percent of GDP in 2007. We expect this ratio to recover somewhat in 2010. However, with domestic growth likely to outpace exports in the medium term, we expect the importance of exports in the economy to gradually decline again thereafter. The share of China's exports to emerging markets around the world rose further in 2009 as the share of exports to the United States, EU and Japan declined to 46 percent, with the share of the United States at 18.4 percent.

|