|

|

|

ARCHITECT'S BLESSING: On January 22, 1992, Deng Xiaoping, architect of China's reform and opening up, visited Shenzhen. Deng's recognition pushed forward the development of China's securities market (CFP) |

Kan Zhidong will never forget the resounding bell he heard on December 19, 1990. The sound meant great things for China's future. Ringing that opening bell, then Shanghai Mayor Zhu Rongji announced that the Shanghai Stock Exchange (SSE) was officially open. The SSE was the first bourse in China after 1949.

As the then General Manager of the Shenyin Securities Co. Ltd. (Shenyin), Kan took part in the preliminary work for the bourse's establishment. Shenyin was one of only three securities firms in Shanghai.

Several months later, the Shenzhen Stock Exchange (SZSE) was established on July 13, 1991.

In the 20 years since opening, China's securities market has become the world's second largest in terms of market value, behind that of the United States. By November 24, 2010, there had been 2,077 stocks listed on the two exchanges, compared with only eight in 1990. And now the market capitalization is more than 26.7 trillion yuan ($4 trillion), a substantial increase from 1.21 billion yuan ($182.2 million) in 1990.

Two decades of memories

The establishment of Shanghai and Shenzhen bourses showed the world China's determination to reform, but domestically it aroused suspicions about whether securities market would put China on a socialist or capitalist road.

Cao Fengqi, Director of the Research Center for Finance and Securities at Peking University, was one of the scholars to propose that China have its own securities market. "Controversies abounded about the securities market and people most likely misunderstood its basics" he said.

The debate did not subside until January 1992 when late Chinese leader Deng Xiaoping spoke positively about the securities market during a visit to Shenzhen, Guangdong Province.

"The securities market could have come to a premature end were it not for Deng's recognition," said He Qiang, Director of the Research Institute of Securities and Futures at the Central University of Finance and Economics. "But one thing is clear—it would not have developed to today's scale."

|

|

USHERING IN A NEW ERA: Then Shanghai Mayor Zhu Rongji opens the Shanghai Stock Exchange on December 19, 1990 (CFP) | The securities market was not without its flaws. For example, stock prices were subject to some powerful people's influence in the early years. One day the SSE stock prices witnessed a freefall, triggering panic among investors, said Kan. To soothe the worries, Wei Wenyuan, then General Manager of the SSE, declared in the main trading hall that the market would not continue this tumble. Surprisingly, Kan said, the stock prices soon staged a rally.

But these unhealthy developments caused trouble to the fledgling securities market, including the "8/10 incident" in 1992 and the "327 Treasury bond incident" in 1995. The "8/10 incident" prompted the government to establish the China Securities Regulatory Commission in October 1992 to regulate the securities and futures industry and ensure market order. The "327 Treasury bond incident" led to the promulgation of the Securities Law, which improved the legal environment for the securities market.

Today, China has built up a multi-level stock market system, comprising the main board at the SSE and SZSE, as well as the SME board and the growth enterprise board, ChiNext, at the SZSE.

The market withstood the 1997 Asian financial crisis and the 2008 global financial crisis. And in recent years, they have even started to impact stock prices on foreign stock markets.

Driving economic reform

|

|

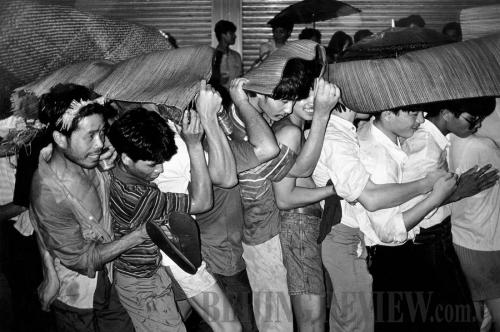

STOCK CRAZE: People from all parts of China wait in wet weather in August 1992 in Shenzhen to scoop up stocks (CIPG) | A report of the global securities giant NYSE Euronext said China was the world's biggest IPO market in the first half of this year in terms of capital raised, followed by the United States and Japan. From January to June, the SZSE led the global capital markets with 161 firms raising a total of $22.6 billion. The NYSE Euronext ranked second with $13.4 billion raised via 55 IPOs. The Tokyo Stock Exchange and China's SSE were third and fourth, respectively.

China used to have an exclusively state-driven economy—the first eight companies listed on the SSE were all state-owned enterprises (SOEs). After being listed, these SOEs displayed remarkable development potential, said Lu Yongzhen, Director of the Department of Capital and Market at the Research Center of the State-owned Assets Supervision and Administration Commission of the State Council.

Meanwhile, more SOEs accelerated their shareholding reform and sought to go public, he said. Now a majority of China's SOEs have become listed shareholding companies, and anyone can become a shareholder of the SOEs via the securities market, said Lu.

|