|

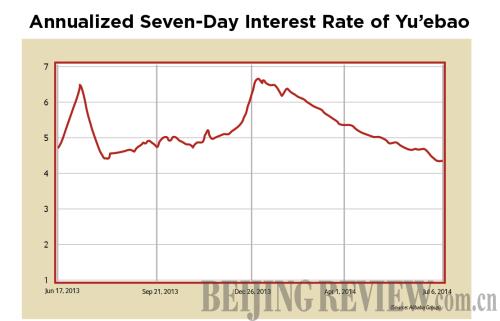

In the long term, the return rate of Yu'ebao will gradually stabilize—just like other ordinary money funds—and it will change in line with money market conditions. It's impossible for them to offer exceptionally high rate of returns for investors, analysts claim.

Although Yu'ebao has been operational for only a year, it has changed the landscape of China's wealth management sector and greatly enhanced people's awareness of money management.

In the wake of huge deposit losses, Chinese banks have launched products similar to Yu'ebao to grab their share of the riches. Although they are latecomers, their returns are now higher than those offered by Internet companies.

For instance, the interest rate offered by Zhanggui Qianbao (which translates to "boss' wallet"), launched by Industrial Bank, and Huoqibao (meaning "due on demand baby"), launched by Bank of China, are both above 5 percent.

Online money funds partially rely on agreement deposits with traditional banks to achieve higher return rates (the banks offer higher interest rates for corporate clients more than individual savers).

"After gathering a large amount of money, Internet companies have to negotiate with banks on the agreement deposits to make profits. Part of the profits will be given to investors while part of them will go to Internet companies. Now, banks have their own online investment products to directly accumulate money. Intermediate links have been reduced, therefore bank-backed online investment products have higher return rates than those offered by Internet companies," said Guo Fanli, Director of Research at the Shenzhen-based industry research company CIConsulting.

"Market-based interest rate reform will be gradually carried out in China. Therefore, the online investment products offered by banks will overwhelmingly defeat those offered by Internet companies in the future," Guo said.

"Going forward, investment platforms by Internet companies will not only focus on money market funds but also find other development opportunities. Other types of funds can be used to ensure steady returns," Guo predicted.

It's also more convenient to use online investment products launched by banks because users have a higher daily redemption limit and can enjoy quicker redemption.

Banks offer instant redemption for their products while in the case of Yu'ebao, redemption for less than 50,000 yuan ($8,000) will take less than two hours while redemption for more than 50,000 yuan ($8,000) will take two days. Some bank-backed investment products don't even need redemption and users can withdraw money directly from the fund through ATM machines.

Diversification

A drop in return rate notwithstanding, Yu'ebao did gather more than 100 million users that are in need to manage their spare cash. Holding such a precious client resource, how to effectively tap the resource has become an urgent task for Yu'ebao.

Faced with a turnaround in their fortunes, it seems that the key to survival of online investment products by Internet companies lies in diversification.

A source from Alibaba Group told National Business Daily that future product innovation in Yu'ebao will focus on two areas: catering to users' consumption demands and offering more various and targeted wealth management services to its 100 million users.

Yu'ebao has reached agreements with major telecom operators that allow users to purchase smart phones using their Yu'ebao fund. The fund can also be used to shop online and pay electricity, tap water and phone bills.

An open investment platform called Zhaocaibao was established by Yu'ebao in April so that financial institutions can sell their products via the platform.

"Zhaocaibao is totally different from Yu'ebao. Financial institutions can sell their products to our over 100 million users. Zhaocaibao has a stable return rate and a fixed period for redemption. It's a complementary service to Yu'ebao where all users can access more professional and more diversified wealth management services," said Wen Tian, Director of Operations at the Wealth Management Division of Alibaba's Small and Micro Financial Services Group.

Email us at: zhouxiaoyan@bjreview.com

|