|

"Compared with other assets, property has lost its attraction as an investment channel. The turning point for China's property sector has come. Even if local governments lift home purchase curbs, it won't make much difference," she said.

Julian Evans-Pritchard, a China economist at Capital Economics, said the downward pressure from a cooling property market can be offset by government-led infrastructure construction and a healthier external economic environment.

Ren Ninghao, an analyst from CIConsulting, said traditional industries face many obstacles in upgrading their businesses while emerging sectors are hardly strong enough to act as the main pillar of the economy.

"The Chinese Government should force fully push forward reforms on state-owned enterprises, fiscal and taxation reform and the adjustment of government functions," Ren said.

Email us at: zhouxiaoyan@bjreview.com

Major Macroeconomic Indicators in the First Half

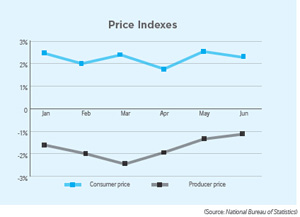

—Consumer price index (CPI), the main gauge of inflation, rose 2.3 percent year on year. Producer price index (PPI), which measures inflation at the wholesale level, contracted 1.8 percent year on year.

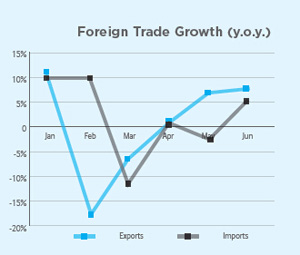

—Foreign trade increased 1.2 percent year on year to $2.02 trillion. Exports increased 0.9 percent to $1.06 trillion while imports increased 1.5 percent to $959 billion.

—Inward foreign direct investment (FDI) into the Chinese mainland stood at $63.33 billion, up 2.2 percent year on year.

—Outward FDI from the Chinese mainland stood at $43.34 billion, down 5 percent year on year.

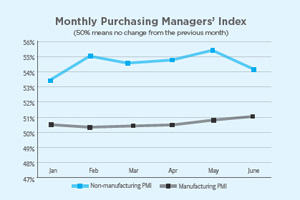

—Value-added output of industrial enterprises above a designated size—principal business revenue of more than 20 million yuan ($3.15 million) a year—grew 8.8 percent year on year.

—Fixed assets investment totaled 21.28 trillion yuan ($3.43 trillion), up 16.3 percent year on year with inflation deducted.

—Retail sales totaled 12.42 trillion yuan ($2.02 trillion), up 10.8 percent year on year with inflation deducted. —The per-capita disposable income of urban residents stood at 14,959 yuan ($2,410), up 7.1 percent year on year with inflation deducted.

—The per-capita cash income of rural residents stood at 5,396 yuan ($870), up 9.8 percent year on year with inflation deducted.

—New yuan-denominated loans amounted to 5.74 trillion yuan ($924.8 billion), 659 billion yuan ($106.17 billion) more than the same period last year.

—As of the end of June, M2, a broad measure of money supply that covers cash in circulation and all deposits, reached 120.96 trillion yuan ($19.49 trillion), up 14.7 percent year on year.

—China's fiscal revenue rose 8.8 percent year on year to 7.46 trillion yuan ($1.21 trillion).

(Source: National Bureau of Statistics, Ministry of Commerce, Ministry of Finance)

|