|

|

|

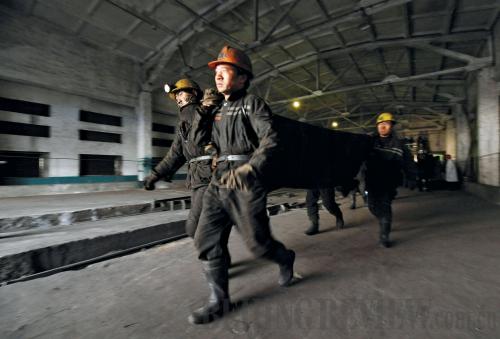

FILLED WITH GRIEF: Rescuers carry a gas explosion victim out of the disaster area in Tunlan Coalmine, Shanxi Province, in February |

Shanxi offers two ways to compensate the coalmines for reorganization: direct economic compensation or substituting resources for shares. To those coal mines to be merged or acquired, the government will grant compensation that is 1.5 to 2 times the resource prices they paid to buy the mining right.

Different voices

The reorganization has greatly raised the threshold of industrial access, giving companies of strength and high industrialization levels more room for development. Not all are pleased with the changes. Many coalmine bosses from Zhejiang who have invested in mining operations that are below the 900,000-ton requirement, will not be qualified to acquire other coalmining businesses. The smaller Zhejiang-owned operations will be merged with either state-owned or private coal mining companies in Shanxi.

At a seminar in Hangzhou, Zhejiang Province, on November 18, economists and lawyers discussed the reorganization policy, assuming the same views and criticizing the policy launched by Shanxi.

Shi Jinchuan, Director of the Center for Research of Private Economy at the Zhejiang University, showed particular indignation to Shanxi's practice of promoting reorganization through administrative means. "I myself think that there is a fault in this matter," Shi said, challenging the standard of annual output of 900,000 tons for single coalmines.

Fu Weigang, a researcher at the Shanghai Institute of Finance and Law, criticized the policy as retrogressive. "Restricting the normal operation of private companies by way of nationalization has undoubtedly encroached on the legitimate ownership of related companies," Fu said.

While the opposition's argument has been focused on the losses to Zhejiang businessmen, with even an early estimate on the losses unknown, few have taken the environmental side effects into consideration, not to mention the matter of resource protection and sustainable development. This lack of consideration has led many experts to side with Shanxi policy supporters.

Wang Jinhua, General Manager of China Coal Technology and Engineering Group Corp., says that the integration of coal resources in Shanxi is of significance to the optimization of the coal industrial structure and the realization of industrial upgrading.

Compared with major coal-producing nations, the coal market in China has a markedly low concentration level, Wang said. In major coal-producing nations such as the United States, Australia and India, the concentration level of the coal market is 70-80 percent, while in China the rate is lower than 20 percent. The diversified market structure and excessive market competition have seriously restricted sound development, leading to a huge waste of resources. To correct the problem, the coal industry must follow the road of intensive operation, mechanization and modernization, he said.

Liu Caiying, Deputy Director of the China Coal Industry Association, thinks that the coal industry must follow a path of high efficiency, safety, orderly development and sustainable utilization. The current structure of the domestic coal industry is extremely unreasonable, featuring a large number of companies and a small scale for many of them. For Shanxi, merging small companies with big ones may be the best way to change the existing structure, allowing more companies to gain a larger market presence.

Who advances? Who retreats?

As for the Shanxi reorganization, ifeng.com launched an online survey to gain feedback from netizens across the country. By November 16, there had been 30,831 participants, with more than 70 percent of them holding that bosses of small coal mines should quit the industry.

Concerning the biggest difficulty in the reorganization process, 47.1 percent of the participants point to the compensation standard for the reorganization agreement; 45.2 percent noted the resistance of coal mine bosses; and 7.7 percent hold it is the reorganization approval procedure.

Whether coal mine bosses should quit, 73.3 percent of the participants say "yes," because it is beneficiary to reduce coal mine accidents, environment pollution and corruption; 22.2 percent say "no," because it may cause a national monopoly of mineral resources; and 4.5 percent are not sure about the answer.

The real question is: How many state-owned companies will advance and how many privately owned companies will retreat?

Figures released by the Department of Coal Industry of Shanxi Province showed that by November 20, 2009, among the remaining 1,053 coalmines after reorganization, 198 were state-owned, accounting for 19 percent of the total. Private coalmines numbered 294, or 28 percent of the total, while 561 were joint stock coalmines, accounting for 53 percent of the total.

"The retreat of small coal mines doesn't mean that private companies will be extinguished from the coal industry," said Pan Yun, Deputy Director of the Shanxi Academy of Social Sciences.

Cui Manhong, Director of the Research Center for Economy and Management of the Shanxi University of Finance and Economics, thinks that judgment in the reorganization process should not be based on "ownership," but "productivity."

According to Cui, during the past three to five years, Zhejiang businessmen invested about 50 billion yuan ($7.32 billion) in Shanxi, but the deterioration of resources and effects on the environment left by the operations cannot be addressed even with 60 billion yuan ($8.78 billion).

Cui warns that other regions relying on resources or resource exploitation should also remember the lesson of Shanxi.

After the reorganization

Up to now, 97.9 percent of the coalmining companies in Shanxi have signed reorganization agreements.

Du Jianrong, Director of the Coal Mine Safety Supervision Administration of Shanxi Province, says that after the reorganization is completed, the losses in life for producing 1 million tons of coal will be reduced by 74 percent. Moreover, after the reorganization, the equipment quality will be improved to conform to state regulations.

According to figures released by the Shanxi Provincial Government, after the reorganization, the ecological environment of Shanxi will benefit the most. By 2015, major sources of pollution will be reduced, the disposal rate of solid waste will reach 85 percent and the reutilization rate of pit water will surpass 90 percent.

The comprehensive utilization level of coalmines will also be further improved. By 2015, the recovery rate of coalmine resources in Shanxi must reach 55 percent, in accordance with state regulations, doubling the present rate. |