| Business |

| Means to an End | |

| China pushes to improve technological competitiveness | |

|

|

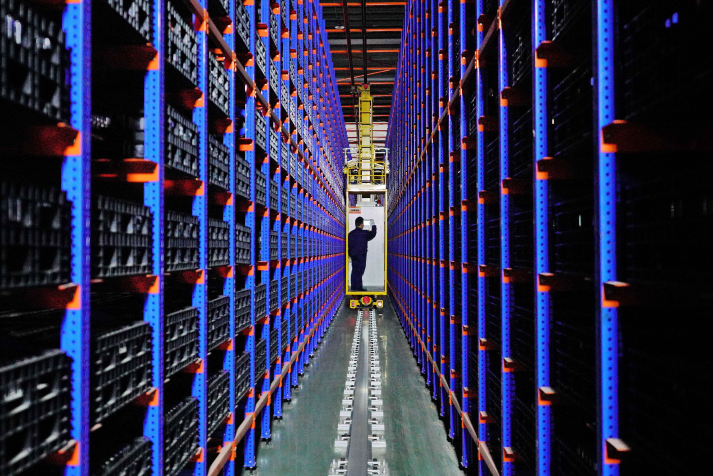

A production line at an enterprise producing lithium cells for automobiles in Tangshan, north China's Hebei Province, on April 11 (XINHUA)

The Chinese Government will offer preferential income tax treatment to enterprises in the field of integrated circuit (IC) design and software, the Ministry of Finance said in a statement on May 22. According to the ministry, IC and software companies that made a profit before the end of 2018 will be exempt from paying income tax for two years, while the income tax rate will be halved to 12.5 percent from 25 percent for the third to fifth years. Amid renewed China-U.S. tensions over trade and technology, observers said China is scaling up efforts to strengthen its technological muscle and reduce risks caused by over reliance on foreign component vendors. In its latest move, the U.S. Government banned U.S. companies from supplying key components to Chinese tech firm Huawei, raising the urgency for China to develop independent core industries, especially semiconductor-related technologies key to producing microchips and other components. According to Chen Baoming, a researcher with the Chinese Academy of Science and Technology for Development, the main goal of reducing taxes and improving support for small and medium-sized technology companies is to encourage domestic enterprises to make further research and development (R&D) efforts in core technologies. "The policies can provide more opportunities for enterprises capable of self-reliant manufacturing and accelerate the upgrade of relevant industries," he told Beijing Review. To meet the stronger demand for science and technology innovation generated by China's economic growth, the country will expand the scale of small and medium-sized technology enterprises and implement policies that promote the commercial use of scientific and technological achievements and intellectual property protection, Yang Xianwu, an official with the Ministry of Science and Technology (MOST), told a recent press conference. Growth and gaps Despite external pressure, China's efforts and proprietary achievements have helped increase its technological competitiveness. According to Wang Zhijun, Vice Minister of Industry and Information Technology, China has made progress in the IC industry, maintaining an annual growth rate of above 20 percent from 2012 to 2018, with sales totaling 653.2 billion yuan ($94.77 billion) last year. China's chip sector is developing rapidly. Data released by the Ministry of Industry and Information Technology (MIIT) showed that the number of chip companies was up to 2,000, and the output of semiconductors grew 9.7 percent year on year to 173.95 billion pieces in 2018. For example, HiSilicon, Huawei's chipset subsidiary, has become a global leading fabless semiconductor and IC design company. It released the Kirin 980 smartphone chip in 2018, the first to be manufactured with cutting-edge 7nm process technology. Huawei also launched the world's first core chip designed for 5G base stations earlier this year in Beijing, with an eye toward further 5G deployments. As China steps up its efforts to cut its reliance on foreign suppliers, there is room for growth in terms of the country's R&D capabilities. Official data showed that the country imported $312.1 billion worth of chips last year, up 19.8 percent year on year. Xie Shaofeng, Director of MIIT's Information and Software Service Division, told a conference recently that China's software industry is plagued by insufficient input and lack of well-trained professionals as well as a gap between supply and demand, which has made it hard for the industry to grow bigger and stronger. Since the launch of two related national funding projects in 2008, the average annual R&D investment had been about 4-5 billion yuan ($638-798 million), which was less than 8 percent of the amount spent by Intel alone, Global Times reported in 2018, quoting the Beijing-based AI-focused website Ai Era. But in 2014, the state-owned China IC Industry Investment Fund Co. (CICIIF) was set up to prop up the value chain of the IC industry, which involves chip design, production, packaging and testing. To date, the fund has invested more than 138 billion yuan ($20 billion) in 70 projects. In addition, local governments in cities like Shanghai and enterprises such as the Semiconductor Manufacturing International Corp., China's largest IC foundry, have launched funds to invest in the semiconductor sector.  Visitors look at products featuring new-generation chips displayed at the Semicon China, an international trade fair for semiconductor technology, in Shanghai on March 14, 2018 (XINHUA)

Research input Basic research, which is the fundamental source of technological innovation, remains a weak point for China, Wang Zhigang, Minister of Science and Technology, said at a press conference in March. He emphasized that technology enterprises should focus more on basic research to explore theoretical breakthroughs. Huawei, the current target of U.S. supply restrictions on Chinese technology enterprises, has invested heavily in R&D since its establishment. Last year, it spent 101.5 billion yuan ($14.68 billion), or 14.1 percent of its global sales revenue, in this field, according to Huawei's 2018 annual report. Over the last 10 years, the company's total R&D expenditure exceeded 480 billion yuan ($69.44 billion), the report showed. Another report released by the European Commission showed that Huawei's 2018 R&D spending was the fourth largest among the world's leading technology companies, behind Samsung, Google and Volkswagen but ahead of Microsoft, Apple and Intel. After a downturn caused by U.S. export controls last year, China's telecom equipment maker ZTE Corp. has bounced back. In the first quarter of this year, the company's revenue reached more than 22.2 billion yuan ($3.2 billion), with 13.9 percent going to R&D. According to Chen, the heightened China-U.S. trade tensions have again highlighted the significance of possessing proprietary core technologies so that enterprises can survive external pressure. "An enterprise may find it easy to expand its scale but only technology can ensure its sustainable growth," he said. Yang said Chinese enterprises' innovation awareness and their R&D investment have improved tremendously in recent years. A report jointly issued by MOST, the National Bureau of Statistics and the Ministry of Finance in 2018 showed that China's spending on R&D stood at 1.76 trillion yuan ($255 billion) in 2017, with almost 80 percent invested by domestic enterprises. Moreover, the proportion of funding for basic science R&D of China's total science and technology budget is on par with those of developed countries. The financial input in basic science nearly doubled from 41.2 billion yuan ($6.5 billion) in 2011 to 82.3 billion yuan ($11.9 billion) in 2016, according to data released by MOST in 2018. The State Council also released guidelines specially focused on improving basic technological research last year. More efforts To inject impetus into China's semiconductor industry, efforts are also needed to build a larger talent pool. According to a white paper released last year, there were only 400,000 professionals in the field in China, while demand is expected to reach about 720,000 by 2020. As the white paper suggested, the talent shortage can be attributed to a string of factors such as unsatisfactory income and low level of commercialization of research results. The average monthly salary in the chip sector was about 9,120 yuan ($1,319), lower than Internet and other technology-related companies. Therefore, many college graduates choose to work for the latter to earn higher salaries. Most importantly, a major problem facing Chinese technology enterprises is the lack of motivation generated by market demand. Although some enterprises excel at R&D, their achievements are inadequately commercialized to create larger markets for sustainable production. Since the market plays a major role in motivating innovation-oriented R&D, technological breakthroughs need to be accompanied by improvement in the overall industrial supply chain to sharpen the edges of the industry, Chen said. For example, China has developed some good prospects in a few fields such as lithium cell production driven by the rise of new-energy vehicles and unmanned aerial vehicles, which have great potential given booming demand and improving technologies. Last year, a Chinese scientific research team developed a greener and more efficient way to extract lithium, essential for powering modern electronic devices, propelling the industry forward. According to Chen, China needs to build a fairer and more nurturing market environment, encourage leading enterprises to improve innovation capabilities and explore the potential of the domestic market to maintain its current competitiveness created by advantageous industries. "The market can give a strong boost to technological innovation. Since China has such a large market, it needs to give full play to this edge to improve the current industries and incubate new ones," he said. Copyedited by Rebeca Toledo Comments to lixiaoyang@bjreview.com |

|

||||||||||||||||||||||||||||

|