| Business |

| Moving the Board | |

| China's new stock trading platform for science and technology startups is launched | |

|

|

Yi Huiman, Chairman of the China Securities Regulatory Commission, addresses the launching ceremony of the sci-tech innovation board of the Shanghai Stock Exchange at the Lujiazui Forum in Shanghai on June 13 (XINHUA)

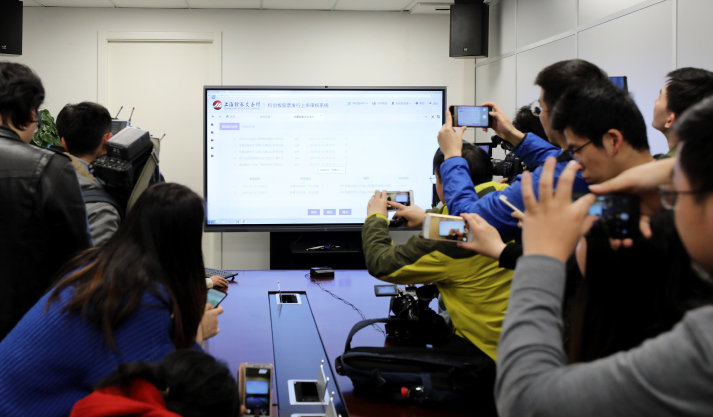

Six emerging tech firms have been given the green light to proceed with the process for listing on China's science and technology innovation board, which was launched by the Shanghai Stock Exchange (SSE) on June 13. Shenzhen Chipscreen Biosciences Co. Ltd., Anji Microelectronics (Shanghai) Co. Ltd. and Suzhou TZTEK Technology Co. Ltd. have become eligible to trade shares on the sci-tech innovation board, according to an SSE announcement on June 5, making them the first companies to pass the bourse's review. They were followed by RICOM Group, HYC Technology Co. Ltd. and Raytron Technology Co. Ltd., which had their listing applications cleared on June 11. "Calculated by the related process, the first initial public offerings (IPOs) on the sci-tech innovation board are likely to be in July," said Bu Na, an independent financial commentator, in an interview with China Business Journal. "This is the start of the pilot registration-based IPO system in China, which is very exciting." On November 5, 2018, President Xi Jinping announced at the opening ceremony of the First China International Import Expo in Shanghai that the SSE would launch a sci-tech innovation board and experiment with a registration-based system for listed companies to carry out the innovation-driven development strategy and promote financial reform. Speaking at the launching ceremony of the new board at the Lujiazui Forum in Shanghai, Yi Huiman, Chairman of the China Securities Regulatory Commission (CSRC), pledged to stick to the market-oriented, law-based and international approach and ensure the solid implementation of all reform measures. Innovative features Shenzhen Chipscreen, a drug developer focusing on novel small-molecule pharmaceuticals for oncology, metabolic diseases and autoimmune diseases, aims to raise 804 million yuan ($116.7 million) to establish an innovative pharmaceutical research and development (R&D) center and regional headquarters, fresh pharmaceutical production bases and online marketing networks, as well as launch the operation of novel pharmaceutical projects. During the 2016-18 period, the company's annual sales revenue stood at 85 million yuan ($12.34 million), 110 million yuan ($15.97 million) and 147 million yuan ($21.34 million), respectively, while its net profits topped 5.39 million yuan ($782,290), 25.91 million yuan ($3.76 million) and 31.28 million yuan ($4.54 million), respectively. Anji Microelectronics, a developer of advanced materials for semiconductor products, plans to raise 303 million yuan ($43.98 million) to fund projects for an integrated circuit production base, an integrated circuit R&D center, and information system upgrading, among others. From 2016 to 2018, its sales revenue was 197 million yuan ($28.59 million), 232 million yuan ($33.67 million) and 248 million yuan ($35.99 million), respectively, while its net profits stood at 37.1 million yuan ($5.38 million), 39.74 million yuan ($5.77 million) and 44.96 million yuan ($6.53 million), respectively. Suzhou TZTEK, which produces precision instruments and artificial intelligence equipment, is set to raise 1 billion yuan ($145.14 million) for expanding production, improving R&D capability and replenishing working capital. From 2016 to 2018, its sales revenue was 181 million yuan ($26.27 million), 319 million yuan ($46.3 million) and 508 million yuan ($73.73 million), respectively, while its net profits reached 31.64 million yuan ($4.59 million), 51.58 million yuan ($7.49 million) and 94.47 million yuan ($13.71 million), respectively. "These three companies are in line with the positioning of the new board, with adequate sci-tech innovation properties," Zhang Aoping, Managing Director of Real Capital, a Beijing-based investment bank, told China Business Journal. In an article in The Beijing News, Pan Helin, a financial commentator, said the reason the three companies were the first to complete the issuance and listing review process was mostly due to their innovation capability and business strength. They are all industrial leaders in their respective domains. In addition, their sectors—bio-pharmaceuticals, microelectronic materials and precision testing—are emerging and have strategic significance for national development. In 2018, the three companies invested 29, 22 and 16 percent of their respective sales revenues in R&D, higher than the industrial average. They are also highly accepted by the market due to their business performance. The SSE stressed that the sci-tech innovation board will give priority to supporting enterprises that are in line with national strategies, master key core technologies, boast outstanding capacity for innovation and rely mainly on core technologies for production and operation. The listed companies should also have a stable business model, high market recognition, a good image in society and great potential for growth. "We believe that guaranteed by related systems, all the companies that can finally list on the sci-tech innovation board should be those in line with these requirements," Pan said.  Journalists attend a media briefing on March 22 where the Shanghai Stock Exchange introduced the review process for listing on the science and technology innovation board (XINHUA)

Innovative board "Establishing the sci-tech innovation board and piloting the registration-based IPO system is a key reform initiative for the capital market to enhance the capability to serve sci-tech innovation enterprises, raise market inclusiveness and strengthen market functions," said an SSE announcement last November. It stressed that through new mechanisms of stock issuance, trading, delisting, investor suitability and capital restriction for securities companies and through introducing medium- and long-term capital and other supporting measures, the pilot program will be carried out in an incremental way. New capital will be introduced in accordance with the progress of the pilot program, thus aiming for a balance between investing and financing, primary and secondary markets, and the interests of old and new shareholders in listed companies, facilitating positive market expectations, according to the SSE. On March 22, the SSE announced that it would accept applications of the first batch of nine companies for listing on the sci-tech innovation board. Later, on May 27, it said the listing committee review meetings would be organized in accordance with existing rules. Each meeting will consist of five members, the convener will be determined by a rotating system, and the members will be determined by lot and must meet the relevant requirements for professions and sectors. The SSE's review for IPOs on the sci-tech innovation board mainly includes two processes: acceptance and inquiry for review. In the first process, only factors such as the completeness of a company's application documents and the qualification of the intermediary organization are verified. The second process focuses on substantial issues such as whether a company meets the requirements for issuance and listing. The listing committee will deliberate on the review report issued by the SSE's review body and the listing application documents, and make judgments on the contents of the review report and the preliminary review opinions put forth by the review body after thorough discussions. In accordance with the principle of majority rule, it will approve or disapprove the issuance and listing. After passing the listing committee's deliberations, the applicant companies can begin their CSRC registration, which should be completed within 20 work days. As of June 10, the SSE had handled 119 applications for listing on the new board, with 97 of them going through the inquiry process, according to its figures. Copyedited by Rebeca Toledo Comments to wangjun@bjreview.com |

|

||||||||||||||||||||||||||||||

|