| Opinion |

| Economic Transition | |

| Vice president of China/Asia Pacific strategy and global digital practices at consulting firm Tompkins International | |

|

|

Stock traders in New York, factory workers in Shenzhen, freight companies in Seoul, technology and retail companies in Hangzhou and luxury fashion executives in Paris all have one thing in common. The state of the Chinese economy matters to them. Stock traders in New York, factory workers in Shenzhen, freight companies in Seoul, technology and retail companies in Hangzhou and luxury fashion executives in Paris all have one thing in common. The state of the Chinese economy matters to them.China's economic growth in 2018 was reported to be 6.6 percent, the "slowest in 28 years." This has prompted questions both inside and outside of China about what this number means for the country, for global markets, for consumption, for manufacturing and exports, and for the overall health of the global economy in 2019. With China driving a significant portion of global economic growth over the past 20 years, any significant slowdown is of concern. The old saying about the U.S. economy that "when the United States sneezes, the world catches a cold," is now true of China. What happens in China matters to the whole world. But should the slowest growth in 28 years be a significant concern for all interested parties? Yes and no. An economy that has grown as fast and dramatically as China over the last decades to become the second largest in the world is, and should be, an object of wonderment, speculation, scrutiny and proven veracity. Economic sinologists, again inside and outside of China, study every piece of news, every photograph and every indicator with microscopic attention. But when looking at a single cell under a microscope, one cannot see the whole muscle, the arm, the body or the soul of an organism. I am of the belief that the Chinese economy is slowing and has been for a few years now. I am also of the belief that no economy that has grown by 14, 12, 10, 8 and 7 percent can sustain that growth forever, nor should it. China's economy, society and role in world economic, political and trade affairs are in a period of transition. The move from a manufacturing and export-centric economy to an innovation, technology, consumption and services-oriented economy is the right strategy for China. But it is not an easy one. Look at what is happening in the United States. The move from a localized, closed, manufacturing, export and production-based economy (1947-80) to an economy defined by financialization (the moment when financial services surpassed goods and services as the majority of the U.S. economy) and globalization has caused severe convulsions in the U.S. economy and for U.S. workers. The last 25 years in the United States have been measured by the idea that a 2 to 3-percent growth is "excellent," while somewhat less than that is normal. So, are there legitimate concerns about China's growth rate and overall economic health? The answer is most certainly yes. China's debt rate, its slowdown in key manufacturing sectors, its decreased purchases of raw materials and commodities, an over reliance on the real estate sector and its continued need for stimulus packages are all causes for concern. These issues, however, must be reviewed in a certain context. The overall growth rate of the global economy has slowed in conjunction with China's slowdown. Europe has dived between contraction and zero to moderate growth. South American economies have been in a free fall. Africa is at best a mixed bag and at worst a serious drag on global growth. When considered from a macro view, China's economy is outperforming most of the world.  A worker at an agricultural product company loads local oranges for delivery in an e-commerce industrial zone in Yichang, central China's Hubei Province, on January 26 (XINHUA)

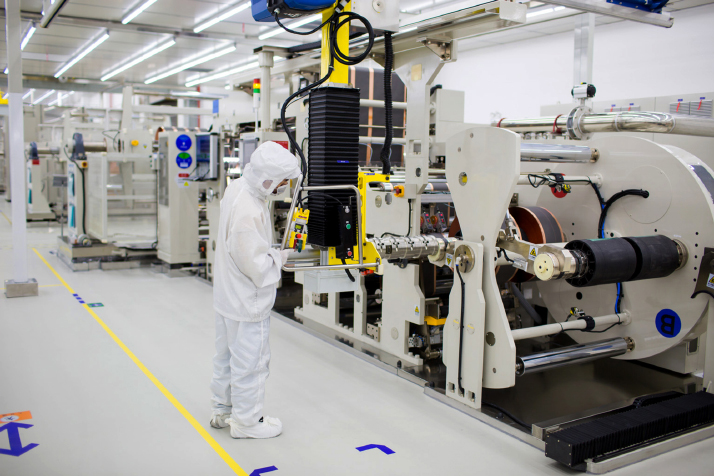

To measure the present situation and to better understand the future, we must look at what has been accomplished in China in the last 40 years. Some key performance indicators include: Lifting more than 700 million rural residents out of poverty; Rising from an economically insignificant part of the global economy to the second largest in the world; Creating an innovative, technology-driven economy that is second only to the United States; Maintaining economic growth of above 6 percent over the last few years as a worst-case estimate in a world where free trade is under fire and globalization's overall value is being questioned; Maintaining growth in the face of the most serious trade dispute in recent history between the top two economies in the world.  A production line staff works at Contemporary Amperex Technology, China's largest automotive battery maker, in Ningde, southeast China's Fujian Province, on January 22 (XINHUA)

Overall economic growth is slowing but growth remains robust in the face of a maturing economy and global economic transition. If we throw the microscope away and look at the entire Chinese economic body, things look promising: A measured transition from manufacturing and export to consumption and services as the key engines of growth is taking place. Consumption in China is robust and many of the long-term indicators project continued growth. Yes, there are downsides and people who are negatively impacted by the transition, but the trend is needed for sustainable growth. Digital Commerce and New Retail are transforming the way Chinese citizens shop, communicate, socialize and consume everything from entertainment to daily groceries. There now exists a digital economy that was almost unthinkable four years ago. Efforts to curtail environmental degradation and amend the damages done are progressing. Although they are and can be uneven, the overall trend is positive. The services sector is increasing on the whole. But the lack of speedier reform in financial services may be holding back even greater growth. Economics and growth are not a zero-sum game; what is good or bad for China is likely to be good or bad for others as well. In addition, the health and well-being of China's economic progress cannot be measured in quarters or years, but in decades. Once when I misbehaved in class and tried to blame it on a classmate, my first grade teacher said to me, "Michael, honey, be careful when you point your finger at someone, because there are always three fingers pointing back at you." That is a lesson I have carried with me throughout my entire life, sometimes successfully and sometimes not so effectively. I am a work in progress. But it is a lesson nations, global institutions, investors, brands and economists should take to heart. The author is vice president of China/Asia Pacific strategy and global digital practices at consulting firm Tompkins International Copyedited by Rebeca Toledo Comments to dengyaqing@bjreview.com |

|

||||||||||||||||||||||||||||

|