|

|

|

(CFP) |

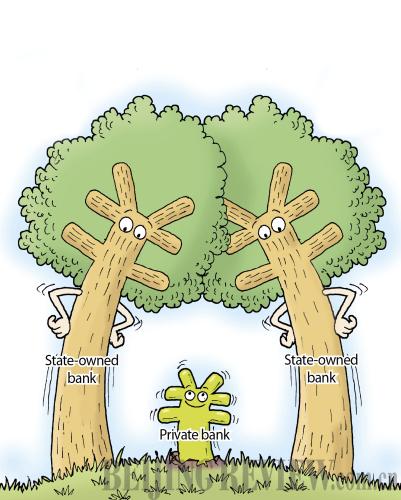

Small and micro companies have always been cast in the role of underdog in terms of obtaining loans from banks, especially large state-owned ones. However, small and medium-sized enterprises and startups will soon have access to other sources of funding. In late July the China Banking Regulatory Commission (CBRC) declared the approval of three new banks wholly funded by private firms, echoing the pilot scheme for setting up private banks announced in March.

The three banks are located in the Qianhai Economic Zone in south China's Guangdong Province, Wenzhou, east China's Zhejiang Province, and Tianjin, a northern port city, respectively. They will start operating between the end of this year and next April.

"Private banks are better placed to establish ties with small and micro enterprises," said Guo Tianyong, a professor of banking from the Central University of Finance and Economics. Given that the founders of the three private lenders are private companies, they will have a more accurate knowledge of the specific needs of small enterprises, Guo said.

Naturally, people can expect private banks to become major force in funding small and micro companies. Yet, the loan morass small and micro firms confront is unlikely to be trudged through in the immediate term, keeping in mind the limited number of approved banks.

"In the days to come, these private banks have to face up to a major challenge—how to innovate a new profit model and system of operations. In other words, they need to make clear their overall positioning and target groups," said Guo.

Shoring up small firms

The Qianhai-based Webank has garnered the most attention, because its largest sponsor is China's Internet giant Tencent, sparking speculation concerning possible financial innovations spurred by Internet technologies such as big data. The other two major shareholders of Webank are Shenzhen Liye Group, a large private enterprise specialized in financial and industrial investment, and Baiyeyuan Investment Co., a Shenzhen-based investment company. Webank will target both individual consumers and small and micro companies.

Guo Wanda, Deputy Director of Shenzhen-based China Development Institute, believed Webank will constructively serve the needs of both individual consumers and small firms. "Emerging financing channels such as private banks and Internet finance will reduce the financial pressures bearing down on small companies, and new innovative products and services will benefit the public practically," he said.

The bank in Wenzhou, co-founded by Chint Group, a private company specialized in industrial electrical equipment production and clean energy, and Huafon Group, a private enterprise producing new chemical materials, is orientated toward local small and micro companies, individual businesses, residents and clients in rural areas.

Given the large quantities of small enterprises in Zhejiang, the public have put a lot of faith in the first private bank in the province, hoping that the shortage in loan supply may now be ameliorated.

"Without a doubt, the establishment of private banks will help make full use of private funds standing idle and lift cash-stricken small enterprises out of their present mire," said Xu Zhiwu, Vice President of Chint Group, suggesting that in Zhejiang, while people holding capital find it difficult to source investment opportunities, startups also feel frustrated in their attempts to get loans.

The bank in Tianjin will specialize in corporate banking services for small and micro firms, with Huabei Group, engaged in electrical cable production, property, finance and logistics, and Maigou (Tianjin) Group, which operates in commercial property, retail and finance, being its major shareholders.

"If financing costs are lowered and there are fewer formalities than there are with state-owned banks, my company would be willing to become the client of the first private bank in Tianjin," Yuan Ruhai, President of Haishun Printing Group, a local private company, told Tianjin Daily.

|