| Business |

| China's foreign exchange reserves rise for fourth month in July | |

|

|

An aerial view of Shihu Port, Quanzhou, Fujian in southeast China, on July 15 (XINHUA)

China's foreign exchange reserves maintained growth for the fourth successive month in July, standing at $3.15 trillion, the highest level in 30 months with a month-on-month increase of 1.4 percent, figures from the State Administration of Foreign Exchange (SAFE) show.

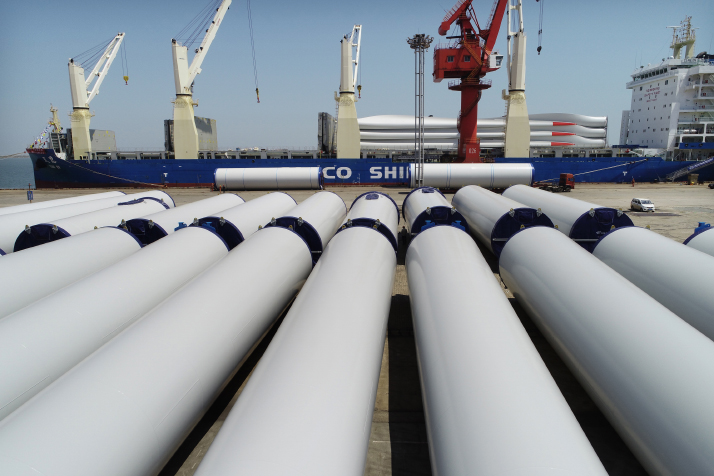

Wang Chunying, SAFE Deputy Administrator and spokesperson, attributed the rise to several factors. "The United States, the European Union and other major world economies intensified fiscal stimulus policies and maintained an ultra loose monetary policy," he said in a press release. "Non-dollar currencies became stronger against the U.S. dollar in the international financial market, and asset prices in major countries rose. Under the combined impact of exchange rate conversion and asset price changes, China's foreign exchange reserves increased." He added that China's foreign exchange market remained steady, with balanced foreign exchange supply and demand. Growth factors Exchange rate conversion has been a major reason for the continuous growth of the foreign exchange reserves, supported by improved foreign trade and cross-border capital flows thanks to the steady growth of the Chinese economy despite the novel coronavirus pandemic. Since April, the U.S. dollar index continued to fall as the epidemic worsened in the U.S. The other reasons for the fall were improved epidemic control in the eurozone, the EU's ability to come up with a 750-billion-euro ($857 billion) rescue plan for its member countries, and optimistic market expectations on the EU fiscal integration. Exchange rate conversions may increase China's foreign exchange reserves by $35 billion, Liu Jian, a researcher with the Financial Research Center of Bank of Communications, told 21st Century Business Herald. Trade in goods has always been an important part of cross-border capital flows and a major source of China's foreign exchange reserves. According to figures from the General Administration of Customs of China, in July, exports and imports totaled 2.93 trillion yuan ($420.98 billion), a year-on-year increase of 6.5 percent. Of the total, exports priced in renminbi were valued at 1.69 trillion yuan ($242.82 billion), up by 10.4 percent. The trade surplus stood at 442.23 billion yuan ($63.54 billion). Improved foreign trade contributed substantially to the rise of foreign exchange reserves in July. Answering media questions on August 7 on China's balance of payments in the first half of the year, Wang said the current account recorded a surplus of $85.9 billion, accounting for 1.3 percent of the GDP during the same period, which was within a reasonable range. Under the current account, the surplus under trade in goods grew compared with the same period last year, indicating that resumption of work and production is improving. The deficit under trade in services narrowed over a year ago. In addition, as the Chinese economy recovers and the financial sector further opens up, foreign capitals are increasingly preferring renminbi assets. Since the stock market was active in July, continuous net inflow of cross-border capitals contributed to the rise of foreign exchange reserves. According to figures from Shanghai-based financial information service provider Wind, since July, China's stock and bond markets have been experiencing net capital inflows. Net inflows from foreign investors' purchase of Chinese stocks reached 10.3 billion yuan ($1.48 billion), while the value of bond depository by foreign institutions saw a net increase of 164.0 billion yuan ($23.69 billion). "The exchange rate conversion, real trade and cross-border capital flows have contributed to the rise of foreign exchange reserves [in July]," Wen Bin, chief researcher with China Minsheng Bank, told National Business Daily. According to his analysis, in July the U.S. dollar index depreciated by 4.2 percent, while major non-dollar currencies all appreciated against the U.S. dollar. The euro, British pound and Japanese yen appreciated by 4.8 percent, 5.5 percent and 2 percent, respectively. As for asset prices, Bloomberg Barclays Global-Aggregate Total Return Index Value Hedged (USD) rose by 1.1 percent. Considering the effect of exchange rate conversion and changes in asset prices, the valuation changes led to the increase in the size of foreign exchange reserves. Wen said as China's foreign trade improved compared with the early period of the coronavirus outbreak, real trade contributed to the rise of foreign exchange reserves. In July, the purchasing managers' indexes (PMIs) in major world economies continued to improve. The PMI of the Institute for Supply Management in the U.S. recovered to 54.2 percent, the highest since February 2019; the PMI in the eurozone climbed over the 50-percent threshold to reach 51.8 percent; and the PMI for China's newly increased export orders rose by 5.8 percentage points over a month ago to reach 48.4 percent, almost returning to the level before the epidemic. Improved external demand also helped the recovery of exports. In July, China's exports priced in U.S. dollar grew by 7.2 percent year on year, the largest growth this year, and the monthly trade surplus also hit a record high of $62.33 billion, Wen said.  Wind power equipment is loaded onto a steamer in Lianyungang Port, Jiangsu Province in east China, on July 24 (XINHUA)

Expectations of stability Talking about the future tendency of China's foreign exchange reserves, Wang said although China has achieved coordinating epidemic control and economic development, the international economic and financial conditions remain complicated and challenging, with great volatility and uncertainties. "Looking ahead, as China has entered the stage of high-quality development and the economy remains resilient, a 'dual circulation' development pattern will accelerate. In this, the domestic economic cycle will play a leading role while the international economic cycle will remain its extension and supplement. This will be favorable for sustaining overall stability in foreign exchange reserves," Wang added. In the future, China has the foundations for maintaining a stable foreign exchange reserve, he said. In the short term, the Chinese economy remains resilient. With a 3.2-percent GDP growth in the second quarter, China is very likely to be one of the few world economies, if not the only one, to see positive economic growth in 2020. In particular, against the global background of negative interest rates, renminbi assets will be more attractive to international investors. This will boost cross-border capital inflows, so as to maintain a balance between foreign exchange supply and demand and support foreign exchange reserves to stay stable in the short term. "In the long term, China's economic fundamentals will remain sound, and the accelerating new dual circulation pattern will support overall stability of foreign exchange reserves," he added. (Print Edition Title: Record Stock) Copyedited by Sudeshna Sarkar Comments to wangjun@bjreview.com |

|

||||||||||||||||||||||||||||||

|