In Q1, its makeup sales rose slightly in the Asia-Pacific market, reflecting the region's more advanced recovery, primarily in China where occasions to actually wear makeup are on the rise. The net sales in the Chinese mainland saw a double-digit growth, which can be largely attributed to the opening up of domestic travel, especially in Hainan Province where duty-free stores tend to cluster, the company said.

"The Chinese market performed exceptionally well in fiscal 2020. Impressively, we are investing in many compelling long-term growth drivers, including end-to-end innovation with a new center in Shanghai," Fabrizio Freda, CEO of the company, told a conference on its quarterly earnings back in March.

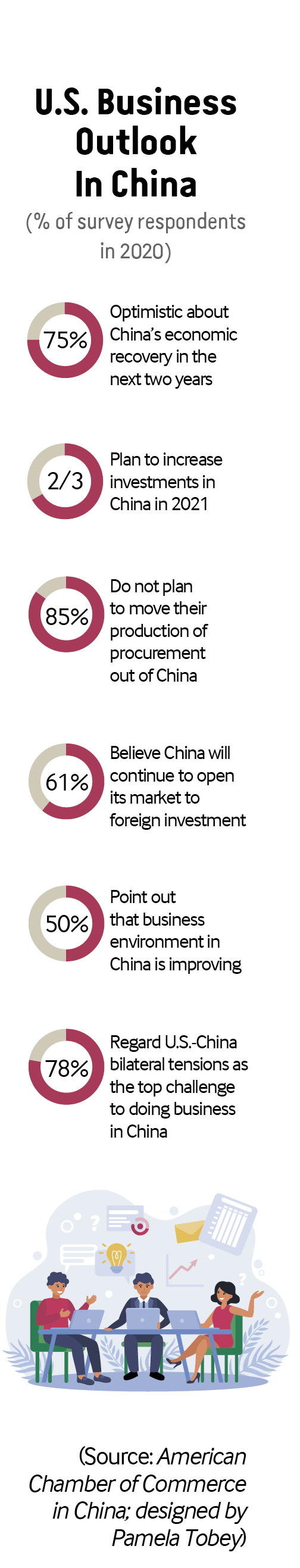

Like Estée Lauder, many U.S. enterprises have remained upbeat about the Chinese market and expect to improve their presence in China. According to the 2021 American Business in China white paper released in mid-May by the American Chamber of Commerce in China (AmCham China), China continues to be a priority market for U.S. companies. Its surveyed member enterprises totaling around 1,000 have provided positive remarks, with 75 percent optimistic about the country's economic recovery in the next two years. More than 50 percent said the domestic growth of consumption and the rise of its middle-income group bring in great business opportunities. While 35 percent registered revenue growth in 2020, 31 percent reported their revenue was comparable to that of 2019.

Half of the companies said China's business environment is improving. With positive market expectations, about two thirds of the respondents plan to increase their investments in the Chinese market this year, with the majority expecting an increase of 1 to 10 percent. A total of 85 percent of the members said they are not considering relocating their manufacturing or sourcing outside of China and 61 percent believe China, as the world's largest recipient of foreign direct investment (FDI) in 2020, will continue to open up its market to foreign investment.

Despite the pandemic and China-U.S. trade tensions, data from the General Administration of Customs of China showed that bilateral trade stood at 1.44 trillion yuan ($224.2 billion) in the first four months of the year, up 50.3 percent year on year. Chinese Vice Premier Liu He and U.S. Trade Representative Katherine Tai talked on the phone on May 27, reaching a common ground that the development of trade links is important and communication is set to continue.

"China is one of the world's largest and fastest-growing markets. Since the Chinese market is a core component of the global strategies of many U.S. businesses, large-scale China-U.S.

decoupling is in the interest of neither side," Nie Pingxiang, a researcher with the Chinese Academy of International Trade and Economic Cooperation under the Ministry of Commerce (MOFCOM), told Beijing Review.

Opportunities and challenges

Data from the National Development and Reform Commission (NDRC) showed that foreign-invested enterprises account for 25 percent of China's GDP and 20 percent of its tax revenue. These companies also provide around 10 percent of total jobs and 50 percent of trade value.

China has made steady strides forward in terms of improving the business environment, enhancing the protection of intellectual property rights (IPRs) and opening up the financial industry, Greg Gilligan, Chairman of AmCham China, told an online symposium with the MOFCOM on May 14. Despite the pandemic, the government has continued to introduce policies leveling the playing field for foreign businesses and investors.

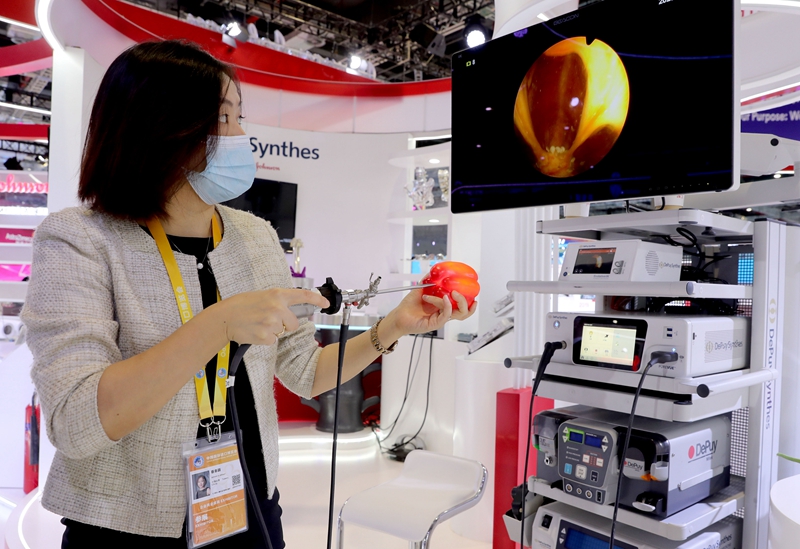

The Foreign Investment Law took effect on January 1, 2020. A master plan for developing Hainan into a world-class free trade port was released last June. In the following July, the NDRC and the MOFCOM unveiled new negative lists for pilot free trade zones (FTZs) and non-FTZ areas across the country, further reducing the areas out of bounds for foreign investors. Three new pilot FTZs in Hunan and Anhui provinces and the capital Beijing were later inaugurated in September 2020, bringing their total number to 21. In May this year, the First China International Consumer Products Expo took place in Hainan, attracting domestic and foreign exhibitors alike.

While opportunities presented by the Chinese market have expanded, 78 percent of the member enterprises view U.S.-China trade tensions as the top challenge to overcome when doing business in China, according to the white paper. Moreover, 46 percent said they would like to see the U.S. Government refrain from taking hostile actions. The influences of rising bilateral tensions were particularly felt across the service industry, where 95 percent of the respondents considered the ensuing uncertainty to be the main challenge.

In 2020, 77 percent of members reported that barriers to market access had inhibited their operations in China to some degree. Although 47 percent of the respondents said the enforcement of IPR protection improved in China in 2020, 48 percent would like to see some further improvement in future negotiations between the U.S. and China, the white paper continued.

China needs to accelerate opening up and improve the business environment by allowing broader access for foreign investment, shortening the negative lists and strengthening IPR protection, Nie said. He suggested a negative list for cross-border trade in services be formulated to facilitate the opening up of the service sector.

Positive benefits

According to AmCham China, U.S.-China economic and trade relations possess positive benefits for both countries. While U.S. enterprises have explored opportunities in the Chinese market, a study in January estimated that U.S. exports to China support around 1.2 million American jobs and that Chinese multinationals in the U.S. employ some 197,000 Americans.

"With China making efforts to improve the business environment and amplify the opening up, China and the U.S. need to develop their exchange and communication to prevent any economic decoupling to benefit their companies doing business on the other side," Nie said.

Although many U.S. companies are confident in the Chinese market, the COVID-19 pandemic and trade tensions are still affecting economic and trade relations between both countries.

A report released by U.S.-based research provider Rhodium Group in May said the U.S. FDI in China stood at $8.7 billion in 2020, down one third year on year. Driven by several acquisitions, China's FDI in the U.S. hit $7.2 billion last year, a slight increase from $6.3 billion in 2019. The bilateral investment prospects this year as of yet leave much room for uncertainty. According to the white paper, the two sides are supposed to promote bilateral investment and trade to help the global economy recover from the pandemic.

China-U.S. cooperation in other fields also has room for growth. According to the white paper, the two economies comprise around a third of global GDP and play a leading role in a number of multilateral organizations, demanding collaboration between both sides on global issues such as public health, energy use, climate change, agriculture and food safety. BR